Whether you live in San Diego or Mobile, Alabama, we all have expenses in life such as rent/mortgage, food, transportation, clothing, health care, education, etc. For many Americans, we’re taught to pay for our expenses by working at a job.

But what happens when working 9-to-5 still doesn’t leave you with enough money to buy everything you need AND want?

Enter Credit Cards

The first universal credit card was introduced in 1950. Since that time, plastic money has allowed people from all walks of life an opportunity to buy items and enjoy experiences they previously weren’t able to afford. However, credit cards have also given many of us a false sense of how much we can truly afford.

With a majority of the public living well beyond their means, it should come as no surprise that credit card debt has exploded in the U.S. In fact, the average American’s credit card debt is around $6,375 per household and rising.

“Credit card usage has become compulsive and addictive,” says Carlos Perez, Director of Counseling Services at the San Diego-based nonprofit credit counseling agency DebtWave Credit Counseling, Inc. “People live their life like they’re not in debt,” Perez says. “We’re that proverbial cold bucket of water waking people up.”

What Perez is referring to is the free credit counseling session DebtWave offers to those throughout the U.S., with the exception of residents of New York, Kansas, and Maryland, as the company is not yet licensed in those states.

Advantages of Credit Analysis with Certified Credit Counselors

Here’s How Credit Counseling Works

When you call DebtWave Credit Counseling, Inc. for a free credit counseling session, you’ll speak one-on-one with a certified credit counselor about your finances.

During this 60 minute call, your certified credit counselor will pull a soft inquiry on your credit, meaning it won’t affect your score, but will allow your credit counselor to view your financial history. At the end, you’ll receive a copy of a personalized Financial Analysis Report, outlining everything you and your counselor discussed.

To begin your credit counseling session, your credit counselor will determine your total outstanding debts and share options for handling that debt, such as:

- Handling the debt on your own

- Declaring bankruptcy

- Enrolling into a Debt Settlement Program

- Liquidating your assets

- Enrolling into a Debt Management Program

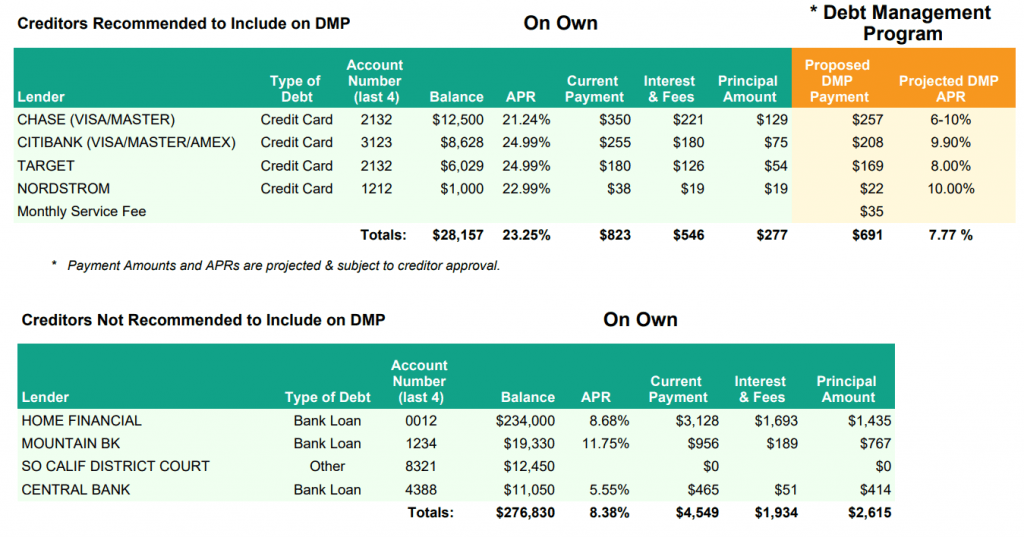

As you can see in the example below from Jonathon Consumer’s Financial Analysis Report, your credit counselor will help you determine not just your outstanding balance on your different credit cards and/or lines of credit; He or she will also help you understand how much of your payment is going toward interest and fees, and how much is actually going toward paying off your debt.

Based on this data, we can see Mr. Consumer has more than $28,000 in credit card debt.

Even though he’s paying $823 per month toward his credit card debts, more than half of that amount, $546, is going toward interest and fees.

Just $277 is going toward his outstanding balance.

Your credit counselor will even detail those figures further with you by showing you how much you can save if you enroll in the nonprofit’s debt management program (DMP), enroll in a debt settlement program, declare bankruptcy, etc.

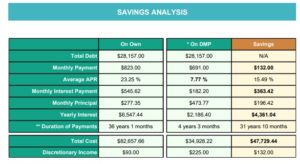

In the example below, you can see Mr. Consumer can save $47,729.44 if he enrolls in DebtWave’s DMP. Additionally, Mr. Consumer would finish paying off his debt 31 years and 10 months sooner than if he continued to pay his debt off himself.

Benefits of a DMP that are particularly attractive include:

- A lower monthly payment

- Lower average interest rate

- One convenient payment that will be disbursed to your creditors by DebtWave

- Lower monthly finance charges

- Debt-free in three to five years

However, a DMP isn’t for everyone. If you enroll in a DMP, your creditors will require each account placed on the DMP to be closed. The reason being, if your creditors agree to lower your interest rate to help you pay off your debt, they don’t want you to take advantage of that lower interest rate to purchase additional items and/or services and further increase your debt load.

Enrolling in a DMP can also temporarily affect your credit score. Keep reading to learn how.

Knowing Your Credit Score

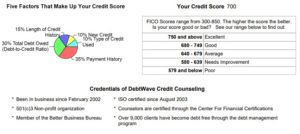

Once you’re aware of the total debts you owe to all creditors, your credit counselor will review your credit score with you, as well as educate you on the five factors that comprise your credit score.

As you can see from Mr. Consumer’s credit score analysis above, about 30 percent of your credit score is based on how much outstanding debt you have compared to how much credit you have available, or your debt-to-credit ratio.

Closing a line of credit may increase your debt-to-credit ratio.

So if your credit score is of concern to you, or if you plan to buy a home in the near future, let your credit counselor know. It’s oftentimes possible to keep one account off the DMP to help you keep your credit score higher than it may otherwise temporarily dip while you’re on the DMP.

Another big factor affecting your credit score is your payment history, comprising 35 percent of your score. It is recommended all accounts on the DMP be current before, during, and after enrolling in a DMP.

While it may seem like enrolling in a DMP isn’t great at helping you build your credit, DebtWave recently published results from a focus group that found that clients who also complete the free Smart With Your Money Financial Education Program at DebtWave saw a positive impact on their credit score.

“We help you learn how to help yourself through behavior modification and how to manage your money better,” Perez said. “We’re not a quick fix. Rather, we represent a time where you learn how to manage in an environment without relying on credit cards.”

Building a Budget

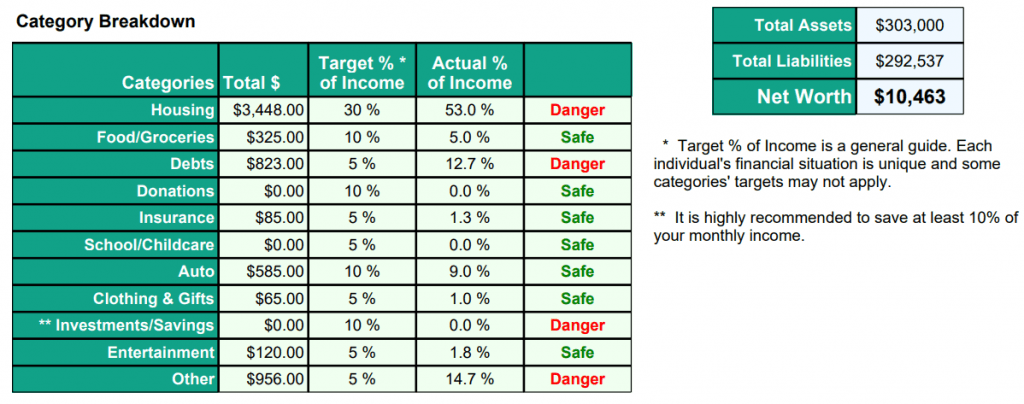

Once you’ve determined your total outstanding debts and credit score, your credit counselor will work with you to create a detailed budget. This allows you to learn where your dollars are predominantly being spent, and whether there’s room for you to save money by cutting out excess or wants.

After determining your take-home pay, your credit counselor will ask you about how much you spend on other monthly expenses such as:

- Housing/Rent

- Food/Groceries

- Donations

- Insurance

- School/Education

- Auto

- Clothing & Gifts

- Investments/Savings

- Entertainment

Once your credit counselor has an idea of how much you’re spending each month, he or she will let you know whether you’re spending is above or below the recommended amount.

In the example below, we can see Mr. Consumer’s current housing, debts, and spending in the “other” category are at a dangerous or unsustainable level.

Other categories such as investments/savings can get flagged if you’re not saving enough, like in Mr. Consumer’s case.

“We take a holistic approach to try and understand your current financial status as well as help you change your behaviors and perception of spending and saving,” Perez said.

Your credit counselor will also inquire about any assets your own such as cars, jewelry, real estate, stocks, etc. This figure is used to determine your net worth, or your total liabilities minus your assets. The reason your credit counselor wants you to have this information is to show you the bigger picture of how you’re doing financially. Similar to how a GPA illustrates a student’s overall academic performance.

Recommendations and Next Steps

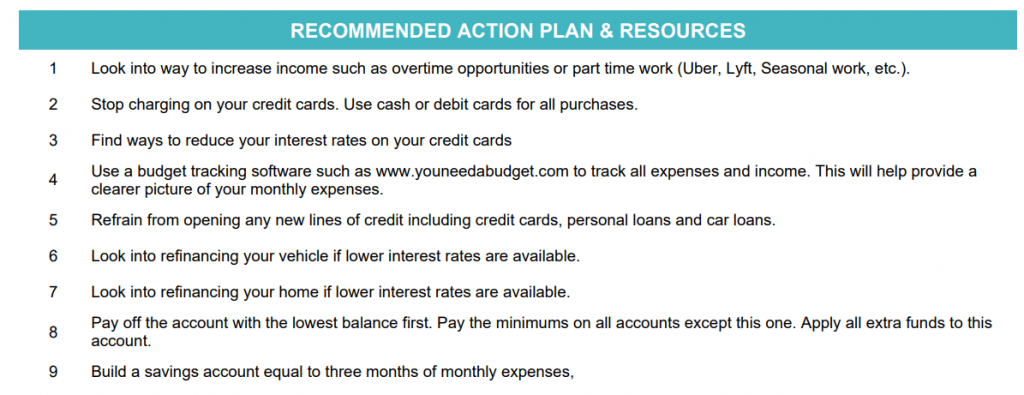

At the conclusion of your one-on-one credit counseling session, your certified credit counselor will share some recommendations and resources to help you get on your feet.

In Mr. Consumer’s case, it was recommended he enroll in the DMP, as well as obtain part-time work or a side hustle. See more of the recommendations below!

Final Thoughts

Trying to break the cycle of being financially dependent on credit cards can be a tough and lonely road.

If you’re looking for some life support, contact DebtWave Credit Counseling, Inc. for a free one-on-one session with a certified credit counselor. Even if the DMP isn’t right for you, you’ll at least have a better idea of where your money is going and have a better understanding of how you can better improve your financial situation.

[…] to view your financial history. At the end of the call, you’ll receive a copy of a personalized Financial Analysis Report outlining everything you and your counselor […]

[…] higher interest rates have you struggling to pay down high-interest credit cards, consider a complimentary one-on-one financial analysis with one of DebtWave Credit Counseling’s certified credit counselors, or start your journey to […]