How to Read Your Credit Card Statement Explained

Some of us aren’t math people. And reading your credit card statement each month doesn’t rank high on our “fun things to do” list. But knowledge is power. And understanding everything happening on your account is crucial on your path to paying off your debt.

Do you remember how old you were when you got your first credit card?

I was 16, a junior in high school. My mom took me to the credit union she frequented and had me apply for a credit card. I was approved for a $500 credit limit (with a co-signer). Which by today’s standards is not an exorbitant amount, but to a 16-year-old with a part-time job, it was a fortune.

While I was warned by the credit union representative to pay the total balance in full each month, no one really explained in terms to me. I couldn’t understand what kind of financial contract I had just entered into or even how to proceed from here.

Why read a credit card statement?

The first few times I got my credit card statement in the mail, I instantly threw it in the recycling. Why did I need this? I know how much I spent and I know I’m supposed to pay it off. Why do I need a piece of paper telling me this?

Credit card statements can be a source of anxiety for those in debt. We don’t want to look at the piece of paper and see the number owed tick higher and higher with each passing billing period.

But credit card statements include so much more information than just the amount owed and the due date. In fact, credit card statements can actually be our ally. They inform us in black and white how much we’re spending, where we’re spending it and how much we owe.

What is a Credit Card Statement?

Essentially, a credit card statement is a summary of how you used your credit card during a specific billing period. Creditors send you your credit card statement each month, not just to inform you of what you owe, but they also include all charges so you can spot any unauthorized charges and/or billing errors.

You should receive a credit card statement via email or paper mail each billing cycle. Billing cycles usually span 25 to 31 days and are used to calculate your minimum payment. Your credit card statement will note how many days that particular creditor includes in a billing cycle.

If you recently opened a new credit card, the credit card companies must give you at least 21 days to pay your balance, or at least a portion of it, before they can legally start charging you interest on new purchases. Which can make the first billing cycle feel longer than others.

Key things to look for when you read your credit card statement:

Account Information:

Commonly located at the top of your credit card statement, this section includes your account number, the date you opened the account, and the dates covered in that particular billing period.

Statement Balance:

Total amount owed on the credit card as of the end of the most recent billing cycle. In order to avoid paying interest charges, the balance must be paid in full.

Tip: Some credit card companies’ billing cycle ends before your payment is due and/or processed. This could make it appear that you owe more on your credit card than you actually do. To lessen the statement balance amount, try paying your credit card bill before the due date. If possible try to make multiple payments per month.

Opening Balance:

How much is owed at the start of the new billing cycle, period. This helps you track how much of your statement balance came from purchases in the new billing cycle and how much was left over from previous billing cycles.

It is possible to have a credit or negative balance, meaning you are owed more money from the creditor than you owe them. This can happen if there is a mistake in a previous bill you were issued, if you return an item, you overpaid during a previous billing cycle, and/or if you earn rewards that are credited to your account. If this occurs you do not owe a payment for this particular billing cycle.

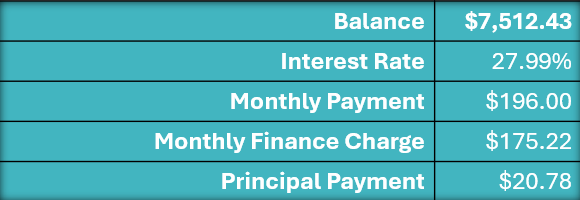

Monthly Finance Charge:

The interest rate applied to your credit card will appear in an monthly finance charge section on your credit card statement. This section will show what your APR is and possibly the expiration date for your current interest rate. It should breakdown the balance that was subjected to an interest charge and how much specifically the bank charged in interest. Reading this can be painful but extremely motivational at the same time. Realizing the price you are paying to borrow money might ignite a positive change in your spending behavior.

Take your monthly payment a subtract the monthly finance charge. This is the amount going toward your principal balance. If you are not happy with how small this amount is, then make a change. Lower your interest rate through credit counseling. Increase your payments. Or do whatever it takes to increase the principal payment.

Make your credit card statement your ally

We get it — receiving your credit card statement when you’re in debt is not a pleasant experience. And can cause high amounts of stress, anxiety, and depression. But if you view your credit card statement as a map detailing where you spent your money, how much of your money is going toward interest and more, you are one step closer to taking control of your financial future.

Feeling Overwhelmed By Debt?

If you find your credit card debt causing too much stress, come up with plan. Stop using the cards. Create a budget to assure that you are spending less than you make. Use an app like You Need a Budget or Every Dollar. Increase income. Decrease expenses. Call DebtWave for help or Create your own Debt Management Plan.