If you’ve made a financial decision in the past that you regret, like taking on too much credit card debt, know you’re not alone. Mistakes are normal in anyone’s financial journey.

Just because you made a money mistake, like not making more than minimum payments on your high-interest credit card, it doesn’t mean you can’t catch up by saving more or paying off debt. However, a new survey from Bankrate found that many Americans are not making the financial progress they’ve hoped for regarding financial regrets.

Survey: 2 in 5 Americans regret not saving enough for retirement or emergencies

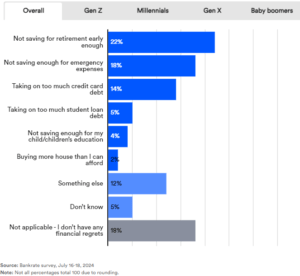

In fact, according to Bankrate’s newest Financial Regret Survey, the majority (77 percent) of U.S. adults have at least one financial regret, including 22 percent who regret not saving for retirement early enough, 18 percent who regret not saving enough for emergency expenses, and 14 percent who regret taking on too much credit card debt.

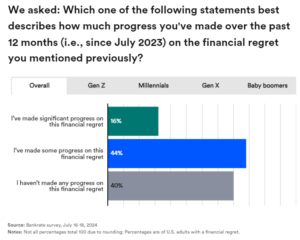

Much to the chagrin of those working on turning around their financial situation, Bankrate found that 2 in 5 (40 percent) people with financial regret haven’t made any progress on their regret over the last 12 months.

The biggest reason? Nearly half (45 percent) of Americans with a financial regret say that over the past 12 months, inflation/high prices negatively influenced their progress on that regret.

Inflation and high prices are cited as the biggest obstacle to progress in addressing our financial regrets,” says Greg McBride, CFA , chief financial analyst for Bankrate. “Don’t expect an overnight fix.”

Over 3 in 4 Americans Have Financial Regrets

Nearly 1 in 4 (22 percent) Americans say their biggest financial regret is not saving for retirement early enough, more than any other regret suggested by Bankrate.

Not saving for retirement early enough has been the No. 1 regret among Americans for six out of the seven years Bankrate has asked about financial regrets. The one exception is in 2021, when not saving enough for emergency expenses was the No. 1 regret.

Another 18 percent say not saving enough for emergencies is their biggest financial regret.

Despite high credit card interest rates, only 14 percent of people say taking on too much credit card debt is their biggest financial regret. That percentage has fallen since 2021, when 18 percent of people said it was their biggest financial regret.

A small percentage of people say their biggest financial regret is taking on too much student loan debt (5 percent), not saving enough for their child’s education (4 percent), buying more house than they can afford (2 percent), or something else (12 percent).

Around 18 percent of Americans reported they don’t have a financial regret at all.

Younger Americans, who are decades away from retirement, are more likely to regret not saving enough for emergency expenses, compared to not saving enough for retirement.

2 in 5 People With a Financial Regret Haven’t Made Any Progress in the Last Year

It can be difficult to catch up after a financial regret, but if possible, it’s important to start now.

However, 40 percent of people with financial regret haven’t made any progress on that regret in the past 12 months. Another 44 percent of people with a financial regret have made some progress in the last 12 months, and only 16 percent have made significant progress.

Inflation remains a sticking point among people seeking financial progress.

Nearly half (45 percent) of Americans with a financial regret say inflation/high prices has negatively influenced their progress on their financial regret over the last 12 months, according to Bankrate.

More people cited inflation or rising prices than any other option suggested by Bankrate, including their employment situation (18 percent), high interest rates (9 percent), family dynamics (7 percent), housing market conditions (3 percent) or something else (8 percent):

Older Americans were more likely to have not made any progress on their financial regret compared to younger Americans.

Around half of people who regret not saving for retirement early enough (51 percent) or who regret not saving enough for emergencies (49 percent) say inflation or high prices negatively influenced their progress on their financial regret over the last 12 months, more than any other type of regret.

Americans who reported their regret was taking on too much credit card debt are the most likely group to have made some progress in the past 12 months on their financial regret (52 percent, with an additional 22 percent saying they have made significant progress).

On the other hand, those with a savings-related regret were likeliest to have not made any progress in the past 12 months, including 51 percent of those who regret not saving enough for their children’s education, 43 percent of those who regret not saving early enough for retirement and 42 percent who regret not saving enough for emergencies.

If you have a financial regret, it’s important to implement small changes as soon as possible – today if possible.

For example, if you regret not contributing enough toward retirement savings, you can increase your retirement contributions now to let those savings grow over time.

Don’t wait for the inflation rate to go down to start working on your financial goals. McBride says that, while the inflation rate is falling, prices are still going up year-over-year — just not as fast as they did in 2022.

While it’s difficult to try and juggle saving for retirement and emergencies, as well as paying down debt, taking small steps towards your goals today will help you see big gains — both financially and in peace of mind — in the future.

If you’re one of the many Americans trying to make financial improvements, but you’re not sure whether you should concentrate on increasing savings or paying off debt, Bankrate Chief Financial Analyst Greg McBride, CFA, recommends prioritizing your debt.

“Saving is a lot less painful than dealing with the debt that results when you don’t have it. Paying down debt means doing without, cutting spending or working more,” McBride says. “Saving for retirement and emergencies can be automated through payroll deduction, direct deposit and automatic transfers. Start modestly and after a couple of pay periods you won’t miss what you don’t see.”

If you are struggling to pay off high-interest credit card debt, now is the time to work on lowering your debt balances by contacting a nonprofit credit counseling organization like DebtWave Credit Counseling.

You can start your journey to financial freedom online or contact one of DebtWave’s certified credit counselors for a complimentary budget analysis here.