Bank of America is the second largest bank in the world based on market capitalization behind JP Morgan Chase. When it comes to credit card debt, Bank of America ranks #5. Their $117 billion in outstanding debt claims 10% of the market share. This puts them behind only Chase, American Express, Citi and Capital One in the credit card space.

With the average interest rate on credit cards nationwide at 22.80%, climbing your way out of debt can be difficult but not certainly possible.

Bank of America Credit Card Hardship Programs

If you find yourself struggling with credit card debt, hardship programs can help. Contact Bank of American directly and let them know details about your financial situation. Be prepared to share details about your monthly income and expenses. Stating that you are simply looking for a lower interest rate and payments won’t suffice. You must have a compelling hardship such as job loss, increased expenses or medical emergency to qualify. Expenses such as eating out, travel and entertainment should all be eliminated from your budget.

Any concessions granted by Bank of America will likely be temporary. A lower interest rate might last less than 12 months. Take advantage of that time and attack your debt with extra payments. Some creditors might reduce your credit limit once they approve you on their hardship plan.

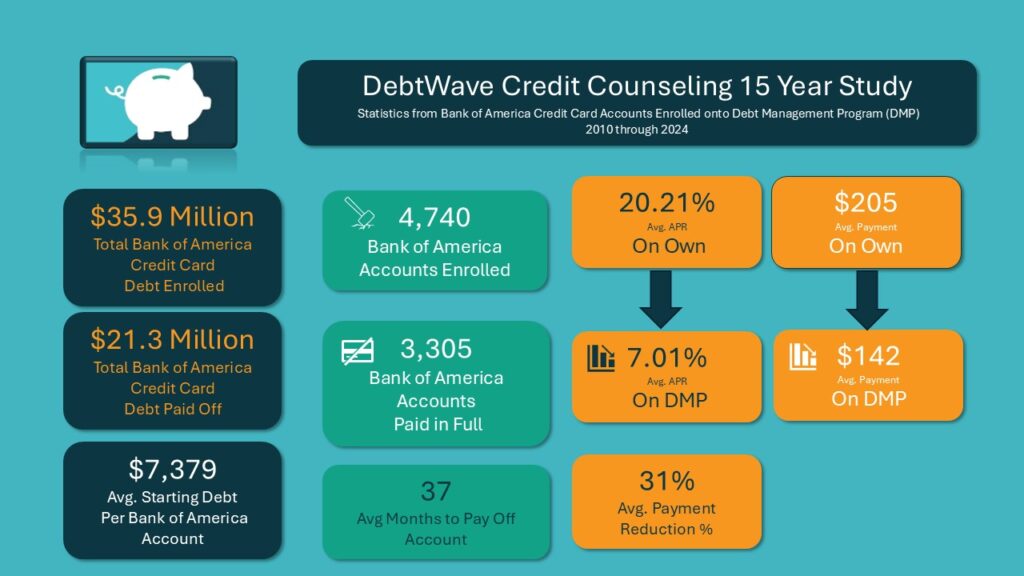

If you want more long term benefits, credit counseling is your next best option. Bank of America works remarkably with nonprofit organizations offering their clients interest rates usually below 10%. Payments typically get lowered as well. Keep in mind that your credit card will be closed on a debt management program. This can be perceived as a good thing for some as the temptation to continue using the card is eliminated.

DebtWave has been helping Bank of America clients for more than 20 years

DebtWave has worked with Bank of America since 2002 helping clients pay off debt at lower interest rates. Most clients add cards with other banks like Wells Fargo and Synchrony. Clients make one payment to DebtWave via ACH either monthly, semi-monthly, weekly or biweekly. And then DebtWave sends payments to their creditors. Most clients complete their program and become debt free in less than 5 years. DebtWave has a 68% successful completion rate.

DebtWave conducted a study during a fifteen year period (2010 through 2024) which they enrolled 4,870 Bank of America accounts onto their program. They found that 3,305 successfully paid their balance in full. And 415 clients are still actively paying down their debt.

The Dream of Getting Out of Debt on Your Own is Possible

Paying back your credit card debt may seem impossible. But it has proven to be achievable by thousands of DebtWave clients. If you would rather tackle the debt on your own, it can be achieved. Create your own plan. The first step is lower interest rates. High interest rates (25-30% APR) on credit cards make it challenging. This would require you to significantly increase your minimum payments (at least 2x) to make progress.

If you have your rates reduced to less than 10%, then use a payoff calculator or google spreadsheet to create a plan. Find ways to increase income and reduce expenses. Stay motivated and refrain from using cards again. Build an iron clad budget that accounts for all expenses.

Accordions

Yes. Most credit card companies have a hardship program. Although, not everyone qualifies. If you qualify, banks will temporarily lower your interest rate for roughly 3-12 months to help you get back on track. Sometimes, they may lower your payment and waive fees. Your financial hardship reason must be compelling to merit the benefits. Loss of income due to unemployment/reduction of hours, medical emergency or natural disaster will like increase your chances of qualifying.

In most cases, yes. But it depends on the terms the creditor is offering. If your interest rates are above 20% and the creditor is offering rates below 10%, then yes. But keep in mind, most hardship plans are temporary. Usually between 3-12 months. Look into credit counseling for a plan to payoff your debt in 4-5 years.

Yes. It can be negotiated, but only if you are severely delinquent. Typically, once you fail to make payments for six months, creditors would be willing to settle for about 50% of what you owe. However, you would need to pay that amount today in order to settle. Also, there will be tax consequences. Whatever amount is forgiven becomes taxable income. Expect the IRS to come knocking on you door to collect. If you are current with your payment, avoid negotiation. Look into hardship plans or credit counseling instead.