Synchrony Financial was incorporated in Delaware in 2003 under its previous name, GE Capital Retail Finance Corporation. Unless you carry some retail store credit card debt, you probably have never heard of them. But you have certainly heard of the major retailers that use Synchrony. Those names include Amazon, eBay, Sam’s Club, Lowe’s and Walmart. In 2018, Synchrony added another big name to the list – PayPal. In less than 20 years of existence, Synchrony landed on the top ten list in Credit Card Market Share by Cards in Circulation.

But unfortunately for their customers, massive amounts of credit card debt emerged as well. As last reported in 2021, Synchrony card holders possess $21.4 billion in credit card debt. As a result, this puts them as the 11th largest bank by outstanding credit card balances.

Why do we get into credit card debt?

The buy-it-now-pay-for-it-later mentality has made many smart people look like fools. We think we can afford something today as tomorrow promises to produce more riches. But that false promise leaves us with a heap of debt and lots of financial stress.

It doesn’t help that the credit card industry is one of the most aggressively marketed products in the world. We see advertisements everywhere encouraging us to use their card to help escape to a much happier place. The big four companies (Visa, MasterCard, Synchrony and Discover) combined to spend roughly $4.5 billion on just marketing in 2020.

On top of the marketing that we see on television and social media, we are encouraged at checkout, both online and in retail stores, to sign up for or use their shiny, beautiful card. Get 10% off your purchases if you use your card! Receive cash back on all purchases! Earn points toward your next luxury vacation! Consequently, these tactics lead some people toward a massive debt problem.

What are your options to pay back your Synchrony credit card debt?

Facing a large amount of credit card debt can be scary. It’s a constant reminder that we messed up. And chances are neither your formal education nor your family prepared you on how to handle this situation.

There are many options to consider when trying to pay back debt. But the one thing that must be done regardless of what option you select is stop overspending. Each time we use a credit card we are likely purchasing something we can’t afford. Put an end to using cards. Create a detailed budget outlining all income and all expenses. Revisit this budget periodically and make revisions. Increase income. Decrease expenses.

Synchrony Financial Credit Card Hardship program

If you find yourself struggling with credit card debt, hardship programs can help. Contact Synchrony Financial directly and let them know your personal hardship. Provide as much details as possible about your financial situation. They will likely ask about your monthly income and expenses. Telling them that you are simply looking for a lower interest rate and payments won’t suffice. You must have a compelling hardship such as job loss or medical emergency to qualify.

Any concessions granted by Synchrony will likely be temporary. A lower interest rate might last less than 12 months. Take advantage of that time and attack your debt with extra payments. Some creditors might reduce your credit limit or even close your card once they approve you on their hardship plan.

If you have no luck getting concessions or want more long-term benefits, credit counseling is your next best option. Synchrony works very well with nonprofit organizations offering their clients interest rates usually below 10%. Payments typically get lowered as well. Your credit card will be closed on their debt management program. This can be viewed as a good thing for some as the temptation to continue using the card is eliminated.

DebtWave has been helping Synchrony clients for more than 20 years

DebtWave has worked with Synchrony since 2002 helping clients pay off debt at lower interest rates. Most clients add other credit cards to their plan such as Capital One and Chase Bank accounts. Clients make payments via ACH either monthly, semi-monthly, weekly or biweekly and then DebtWave disburses payments to their creditors. Most clients complete their program and become debt free in less than 5 years. DebtWave has a 68% successful completion rate.

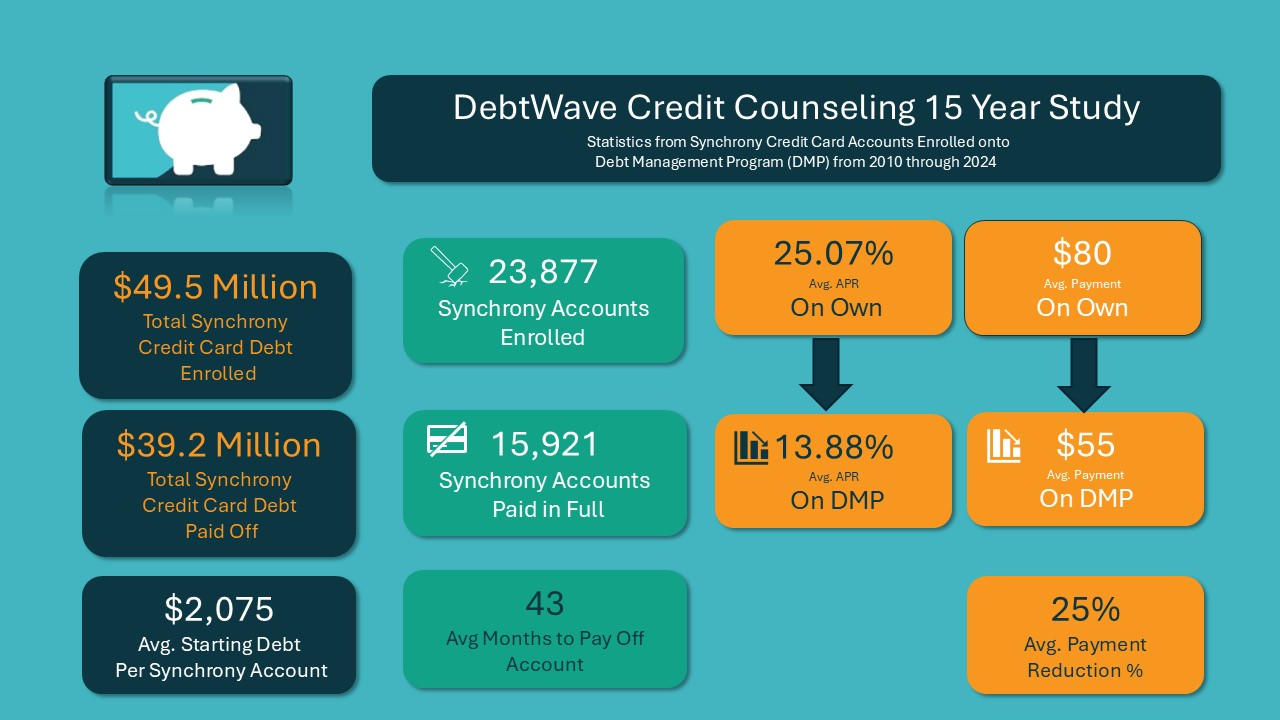

DebtWave conducted a study during a fifteen year period (2010 through 2024) which they enrolled 23,877 Synchrony accounts onto their program. They discovered that 15,921 successfully paid their balance in full. And 1,989 clients are still actively paying down their debt.

Here are some additional stats from the study:

The Dream of Getting Out of Debt on Your Own is Possible

Paying back your credit card debt seems unrealistic. But it has proven to be achievable by thousands of DebtWave clients. If you would rather tackle the debt on your own, it can be achieved. Create your own plan. The first step is lower interest rates. High interest rates (25-30% APR) on credit cards make it challenging. This would require you to significantly increase your minimum payments (at least 2x) to make progress.

If you have your rates reduced to less than 10%, then use a payoff calculator or google spreadsheet to create a plan. Find ways to increase income and reduce expenses. Stay motivated and refrain from using cards again. Build an iron clad budget that accounts for all expenses.

What other stores use Synchrony Financial?

Synchrony issues credit cards for the following brands:

- TJ Maxx

- Marshalls

- HomeGoods

- Macy's

- Ashley Furniture

- Kmart

- JCPenney

- Belk

- Rooms To Go

- Mattress Firm

- QVC

- IKEA

- Menards

- Pier 1 Imports

- Ross

If you are struggling with retail store credit card, seek credit counseling or create a DIY Debt Management Plan.

Accordions

Most credit card companies have a hardship program. On a hardship plan, banks will temporarily lower your interest rate for about 3-12 months to help you get back on track. Sometimes, they may lower your payment as well. Your financial hardship must be compelling to qualify for the benefits.

You must have a legitimate financial setback such as loss of income, job loss, medical emergency or a major increased expense. Credit card companies will likely ask details about other expenses such as rent, food and utilities. Be sure to have your detailed budget complete and available to share with your creditor.

Simply telling them you need lower interest rates and payments likely won't help you qualify. Therefore, be prepared before calling them.

Synchrony does not perform credit counseling in-house. Synchrony works with various nonprofit credit counseling organizations. They offer concessions to these agencies' clients such as lower interest rates and lower payments. In most cases, clients combine their Synchrony credit cards with other credit cards to pay off all their debt.

Most credit card companies do not have a formal forgiveness program. In order for a creditor to forgive a portion of your debt, you would need to be severely delinquent. Usually more than 6 months behind where your credit is ruined. At that point, most creditors would be willing to receive a lump payment of 40-60% of the balance and forgive the remaining balance. However, the amount forgiven would typically be considered taxable income by the IRS.