This might come as a surprise, but credit card interest rates are not etched in stone.

Credit card companies expend a considerable amount of effort and funds to get new customers. Many times, credit card companies are willing to reduce interest rates to keep customers loyal and happy, as well as prevent them from going to competitors.

Most credit card companies will never agree to a zero percent APR interest rate. But, they’ll want to keep you from transferring your (profitable) balance and business to another card, and therefore may be willing to budge a little to keep your business.

It won’t hurt to ask, and you may find that even a small reduction of your interest rate helps get your balance in check. Check out this free credit card payoff calculator to see how much you could save with a lower interest rate!

How to Get Lower Interest Rates on Credit Cards

Below we share step-by-step tips to help you negotiate a lower interest rate on your credit cards!

A little homework goes a long way

First, have reasonable expectations of what kind of interest rate will work for your financial situation. Requesting a reduction in the double-digits will likely get you a firm refusal, if not a dial tone or a snort of derision.

You don’t need a huge reduction in your interest rates to see a difference in your pocketbook. Remember, you can always re-negotiate later on after you’ve made regular on-time payments for a period of time.

Next, prepare to give your credit card company a call. Start with your oldest card first – loyalty counts! Most people dread calling, but customer service is there for a reason, not just for when you need to make a payment or report your card lost or stolen.

Look around at competing cards before you call and mention during your conversation that you are considering transferring your balance or using a different card altogether if you don’t get a reduced rate. It’ll help to have some candidates to name.

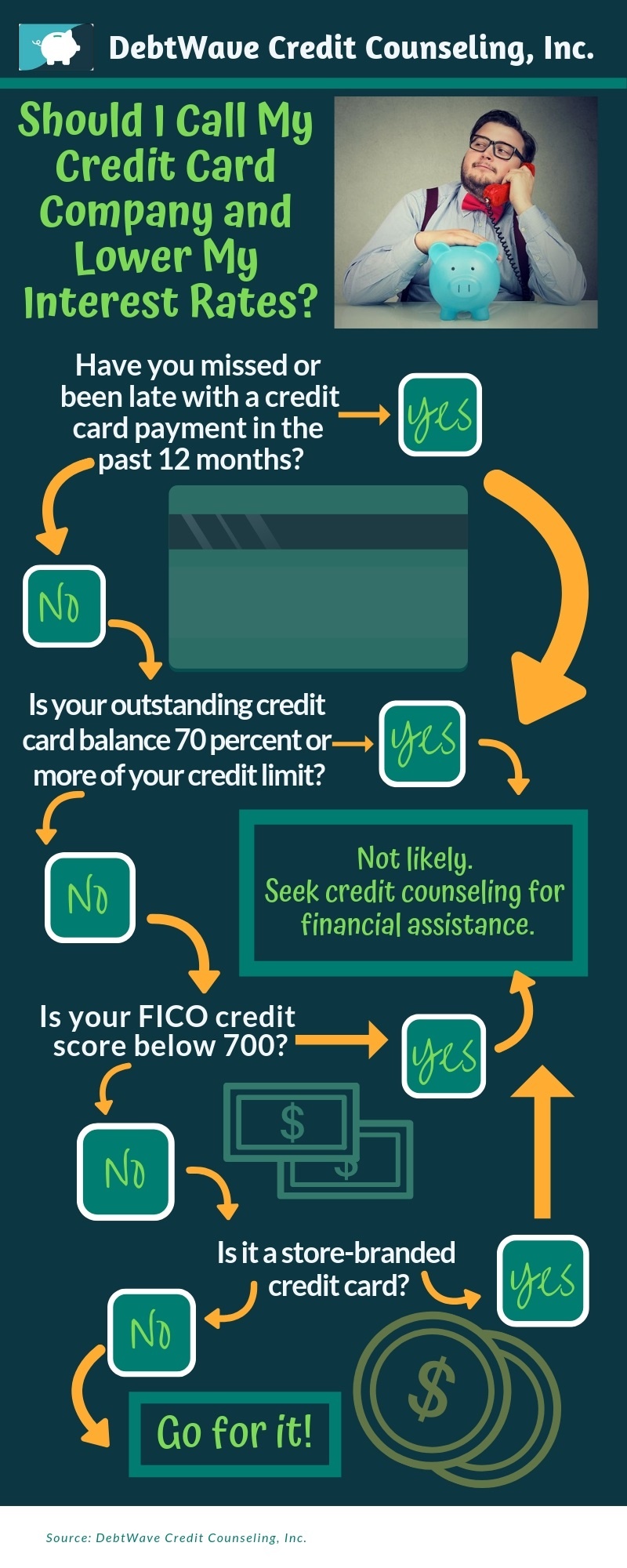

Check your credit report to make sure that your score is healthy and that you are not using a tremendous amount of your available credit.

Some people may find that preparing a script to follow while making their request helps. A script might go something like this:

Hello, my name is _____. I’ve been a customer of [bank or card] for X years. I think I’ve been a good customer over the years, and I’d like to keep doing business with your company, but my APR seems high. I’d like to talk to someone about reducing my rate. Is this something you can help me with?”

If they say no, you can always ask to be transferred to a supervisor or to someone who has the authority to look into adjusting your rate.

When you do get a chance to speak to someone who can help you, be prepared to politely explain why you’re a good customer that they would do well to keep. Don’t be afraid to bring up your excellent payment history, or your loyalty to the card.

Be patient

You may not get the results you want on your first try. Call at least once a year to negotiate your interest rates. Card issuers may be more likely to grant a lowered interest rate if they see a proven track record of responsible credit use and timely payments.

If your request gets rejected, don’t be afraid to ask for the reason why you were denied.

It’s never pleasant to hear why you were told “no,” but asking why they did not reduce your rate can give you valuable information that you can work on to improve for when you try again. For example, if you were denied because of late payments somewhere in your history, you can ask what you need to do to qualify for a lowered rate in the near future.

It’s disappointing to have to accept the loss and move on, but it’s never a bad idea to practice being your own advocate when dealing with credit card issuers. If you are not having any luck negotiating a lower APR, contact DebtWave Credit Counseling for a free counseling session.

Consider a balance transfer card

If your request for reduced interest rates is denied, see if you qualify for a balance transfer card! Balance transfer cards are a good alternative if high interest is beleaguering you and your card issuers won’t budge on the rate.

You’ll want to find a card with a lengthy introductory term of zero-percent interest, as well as a transfer fee of no more than 5 percent of the balance you’re transferring.

As an added benefit of using a balance transfer card, the issuer who initially refused a reduced rate may begin marketing to you to earn back your business. Once you’ve paid off your balance, you can then contact your old issuer and find out how they may be more willing to accommodate you to get you back as a customer.

How to keep your new rate low

If you successfully negotiate a reduced rate, congratulations! Your first step is to make sure you get everything in writing, in case your rate mysteriously shoots back up with your next statement, or your card issuer suddenly changes terms on you.

Next, and after that, always pay on time. No matter your history, if you pay late on any credit card, you face a sharply increased interest rate.

Keep your overall credit utilization ratio low, below 30 percent. Using most of your available credit affects your credit score, which may result in bumped interest rates, even on cards that you do not carry a high balance on.

Lastly, a word of warning: beware of unsolicited phone calls from companies that offer to negotiate lower interest rates on your behalf for what they claim is a nominal fee. Most of these calls are scams, and you can accomplish what they offer for free, on your own.

Have you successfully negotiated a lower interest rate on your credit card? Share your success stories (and failures) with us in the comments below!