Depending on how long you’ve been part of the Debt Free Community you may have come across debt free charts. Designed by Heidi Nash of DebtFreeCharts.com, these colorful illustrations are a way to track your debt payoff progress or monitor your savings goals progress.

DebtWave Credit Counseling Inc. recently caught up with Nash, whose goal is to give away 150,000 free charts in 2018. Check out what she had to say below!

DebtWave: How did you get involved in the debt-free community?

Nash: We were the typical American couple, no budget, consuming all of our income each month, and using credit cards to buy and pay for the things we didn’t save up for.

We weren’t frivolous, didn’t finance new cars, didn’t buy fancy electronics, didn’t spend a lot on clothes or go on European vacations. What we did do was charge small things, go out to nice dinners because ‘we deserved it’, gifts at Christmas and birthdays, and the inevitable yearly expenses that somehow managed to sneak up on us every year, like property taxes and car repairs.

I started a small jewelry business so I could work from home and ended up charging lots of supplies. Whenever I made some sales, the income would disappear into the hole we had dug, instead of paying off the debts. We limped along like this, never completely falling, never making any progress for over 10 years.

Things began falling apart in 2006 when my husband lost the job we thought would be forever stable. That year I found the Dave Ramsey book The Total Money Makeover and managed to get a copy from our local library. I devoured it, and finally had a clear picture of how stupid we had been with our money.

DebtWave: What inspired you to create debt-free charts?

Nash: When we had a big debt mountain to climb, I wanted something that I could put up on the fridge and see at a glance how we were doing. A thermometer was just too boring for me, so I tried making a chart of the words “Debt Free.” It helped us so much and kept us motivated to keep going.

I made the first chart around 2008. I shared that first chart in an online forum and started making charts by request in that group. After about a year I decided to put them all up on a simple website so anyone could access them, not just the people in that forum.

DebtWave: For those who are not familiar, how do these charts work?

Nash: The charts are for tracking your balance. You divide your total debt by the number of lines to fill in and that is the amount that each line on the chart represents. So if your debt is $5,000, and your chart has 50 lines, then each line is equivalent to $100. You would then write a value on the side of each line, e.g. $0, $100, $200, $300 and so on. Each time you make a payment or add to your savings fill in the chart with a colored marker. I like to use one color per month, so I can see at a glance how I’m doing.

DebtWave: How does coloring in a chart keep someone motivated to pay off their debt?

Nash: It seems so simple, even a little cheesy, but it really does work, especially if you are a visual person like I am. You see your progress, not just in numbers on a spreadsheet, but in big words that you are filling in as you move forward. Seeing how far you’ve come spurs you on to win. It’s incredibly inspiring. It gives you that boost of pride in what you’ve been able to do and helps you see that you can do it, you can become debt-free.

It’s been so wonderful to see the charts helping so many people the way they helped us. A couple of months ago I wondered how many charts I had given away in total. There is no way to know, as I don’t have records from all those years. But with the new website I can keep track, so I thought it would be fun to set a yearly goal, a goal that is a big stretch, a goal that I can’t reach by myself. So I decided that in 2018 I want to give away 150,000 free charts. As of April 30, 2018, I’ve given away 27,015, so I’ve got a long way to go. And that is how you can help me. Go get your free charts and help spread the word!

DebtWave: What kind of feedback have you received from people who use your charts?

Nash: Oh wow, the feedback has been incredible. I get comments all the time on how much it helps. Comments like “I’m OBSESSED with these charts!”, “Debt Free Charts is one of the best things to happen on the debt-free journey,” “So motivating to color this baby in,” and “I love these charts so much. You wouldn’t believe how great it feels to pay a bunch of money so that you can color in a line.”

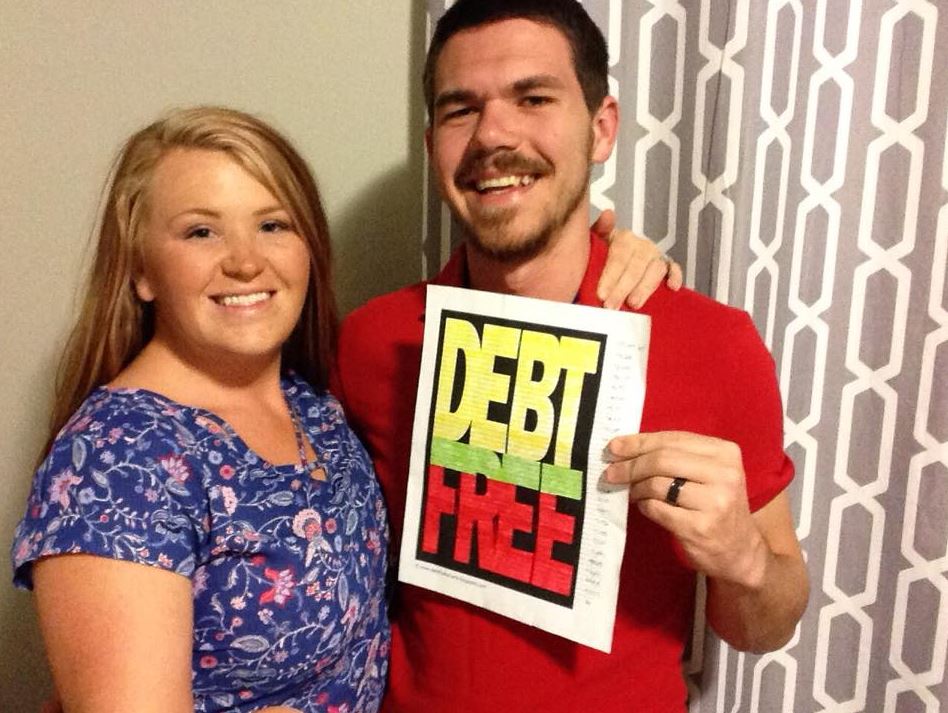

I’ve seen so many people use the charts to help them knock out their debts that I started putting their chart pictures on my website, you can see them on the Wall of Fame on our website. If you’d like to get your finished chart on the Wall of Fame page, you can email a photo to Heidi at hello@debtfreecharts.com or use the tag #DFCWallofFame on Instagram.

DebtWave: Are these charts only for those in debt?

Nash: There are also over 50 charts for your savings goals too, and those are just $1. From saving up a big emergency fund and funding your Roth IRA, to saving a house down payment or a family vacation.

DebtWave: How can someone get started with using your charts?

Nash: Start by getting one chart for your current debt that you are working on. There are 26 free charts currently. Next fill in your numbers following the directions on the website, then get coloring! You can even fill in charts for the debts you’ve already paid off, which can really be encouraging.

So there you have it. Head on over to the Debt Free Charts website and get yourself some free charts, then help spread the word. Happy coloring!