Do It Yourself Debt Management Plan

Paying off credit card debt without a plan can be very stressful. But having a concrete plan to become debt free can give you confidence. And when you have confidence, stress can disappear.

Your parents probably never taught you how to avoid debt. Your high school never provided instructions on how to use credit cards wisely. And your college failed to hand out degrees in Credit Card Debt Management. But despite falling deep into credit card debt, you have the confidence to slay the dragon of debt on your own.

Can it be accomplished? Of course! You just need a plan, some tools, a heavy dose of discipline and a plethora of motivation to cross over to the world of financial freedom.

Create Your Plan in Six Simple Steps

1. Add up the Total Damage

They say the first step is the toughest one to take. But when it comes to managing your debt, adding up the damage ranks as the scariest step. Too many people underestimate their total debt. Once you use a calculator to add it all up, it usually totals to about 10% higher than you thought.

Get organized. Use a spreadsheet to enter the name of each creditor, the balance, interest rate and monthly payment. We recommend listing the monthly finance charge as well for extra motivation. Use our Credit Card Debt Management Payoff Plan Google Sheet Template. Our worksheet already has all these fields built in.

2. Make a Budget Plan

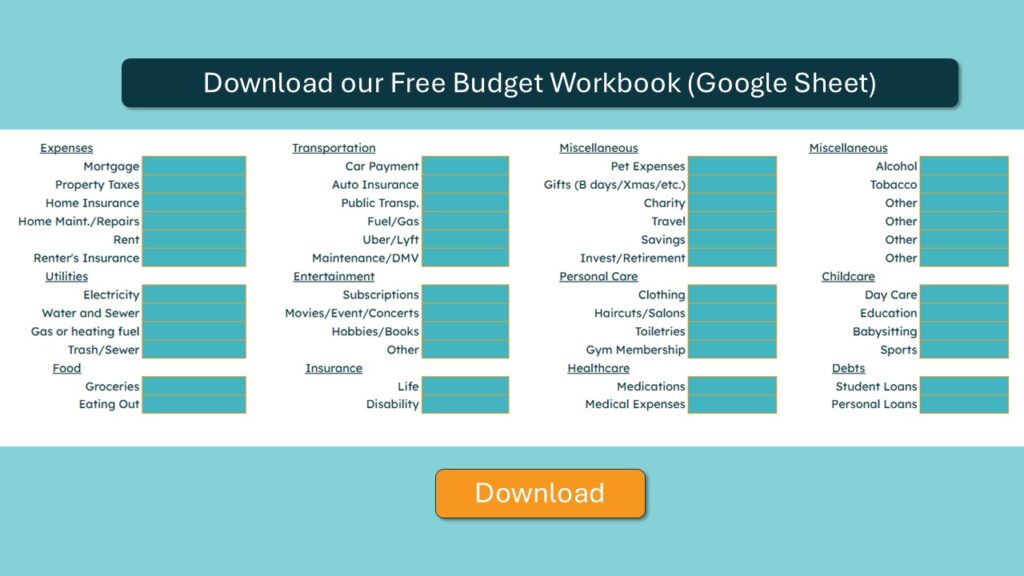

Next, create a budget. It sounds painful and boring, but failing to use a budget is the main reason most Americans’ have credit card debt. Making and sticking to a budget eliminates overspending. Use a budget worksheet that outlines all expenses. You will need to review a list of all bank transactions to give you an idea one what you have been spending on categories like groceries, eating out, toiletries, gifts, travel and many more.

3. Increase Your Payment

Now that you have created a budget, come up with an amount you can pay extra toward your debt. Your discretionary income (monthly income minus monthly expenses) will dictate this amount. If this amount falls close to zero or is negative, revisit your budget. Consequently, make cutbacks to unnecessary items like entertainment, travel or eating out. Also, find ways to increase your income.

Our worksheet will allow you to enter your extra payment amount. As you increase this amount, you will see the difference this payment will make to your payoff date.

4. Pick a Payoff Strategy

The two most common payoff strategies are the Debt Snowball and the Debt Avalanche. With the snowball method, you throw the extra payment toward the lowest balance account while making the minimum payments on the others. The Debt Avalanche has you sending the extra funds to the highest balance account while sending the minimums to the others. It’s up to you to decide which one fits best for you. But we prefer the Debt Snowball for simplicity reasons. Here’s why. Let’s say you have five credit cards:

| Balance | APR | |

| Creditor 1 | $8,000 | 22% |

| Creditor 2 | $2,000 | 0% |

| Creditor 3 | $4,000 | 18% |

| Creditor 4 | $5,000 | 9% |

| Creditor 5 | $6,500 | 24% |

The Debt Avalanche method tells you to focus on paying off Creditor 5 first. Then 1. Then 3. And finishing with 4 then 2. So you began your plan today. You send minimum payments to creditors 1-4. You send Creditor 5 the extra payment amount. Six months later, your rate on Creditor #2 jumps to 27%. And now your focus shifts to creditor number two. Six months later, Creditor 4 increases their rate to 29%. And guess what? Your focus changes again. The Debt Avalanche can be like playing a game of Whack-a-mole where your target continues to change.

Contrary to the Avalanche, the Snowball has a stationary target. The lowest balance will always remain the lowest along as your extra payment is substantial. Mathematicians argue that the Avalanche will save you more money in the long run. And they are correct. But a therapist might tell you the Snowball helps with your mental health. And remaining mentally stable helps you stay on track.

5. Stop Using Your Credit Cards

Now that you have created a budget that shows your expenses are less than your income, you no longer need to use credit cards. Use only your debit card from here on out. But what about more points? Airline Miles? Stop! Your current heap of credit card debt screams “I am not a debt person!”. Put an end to overspending. If you can’t stop swiping your credit cards, then the best debt management plan in the world won’t help you get out of debt.

6. Plan on Measuring Your Net Worth Monthly

Too many people focus on their credit score while paying down their debt. Obviously, credit scores play a crucial role in the financial world but remember the main reason for their existence. Credit scores are the keys that open doors to acquiring more debt. Put an end to your desire to get more debt. Focus on your net worth instead. You can calculate your net worth by subtracting your total liabilities from your total assets. Create a spreadsheet and a monthly reminder to enter your total Net Worth. Watching your number improve every month provides some extra motivation and a boost to your self-worth.

Download our Debt Worksheet to get started today. Without a doubt, having a plan to tackle your debt will lead to success. But if you find your interest rates too high to make progress, inquire about our Debt Management Program.