Credit Card Consolidation

Credit Card Consolidation

The term “credit card consolidation” sounds like a solution to all your credit card problems. But what exactly does it mean. It can refer to many different products or services. If a friend mentioned they consolidated their cards into one monthly payment, it remains unclear what they did. But they likely did one of the two things: obtained a loan or enrolled onto some sort of debt program.

There are four main products or services regarding credit card consolidation. Obviously each possesses their own pros and cons.

Let’s say you have 4 credit cards carrying a balance of $10,000 on each of them. And your average APR sits at 21%. Consolidating your credit cards intrigues you. But it also scares you to try something you don't understand. So let’s explain how these four different options can help you.

Debt Consolidation Loan

The most common of the credit card consolidation options stands the Debt Consolidation Loan. Just as it sounds, this service involves a financial institution giving you a loan in the amount equal to or near the total balances of your outstanding credit card debt. A debt consolidation loan combines multiple debts into a single loan which can simplify finances for some people. Most personal loans generated today are for debt consolidation.

Now with your $40K of credit card debt, you hope for a loan to pay off your balance. So you apply for a debt consolidation loan for $40K and the bank approves you. Then the bank pays each of your creditors in full. But the they charge a 5% origination fee which comes out to $2,000. As a result, your total loan amount climbs to $42,000.

Pros of a Debt Consolidation Loan

- Instead of 4 payments to make each month, you only have one.

- You likely have a lower interest rate.

- Your four credit cards have a zero balance.

- Your debt will be paid off faster than on your own.

Cons of a Debt Consolidation Loan

- Your overall total debt amount increased due to the origination fee.

- Credit score may have been lowered due to a hard credit pull and higher debt amounts.

- The root of your problem (overspending) hasn’t been fixed. You may be tempted to start using these cards again. Especially with the balances being zero.

- Requires good credit and bank approval.

Advice: Negotiate the origination fee down as close as you can to 1%. Avoid using credit cards in the future. Make sure the interest rate is lower that what your credit cards are. Do the math on the total payoff amount. For example, $800 monthly payment for 60 months = $48,000. That make sense with a total debt of $40K.

Best companies offering this service: Best Egg, Sofi, Discover, Any Credit Union or Bank

0% Balance Transfer

Perhaps the most enticing of the four options is the almighty Balance Transfer. After all, you can’t have a better interest rate than the zestful 0%! Many people with good credit play the zero percent game. Meaning once the zero percent interest rate expires, transfer that balance to another lender. So they repeat this process until the offers run dry.

The balance transfer is very similar to the debt consolidation loan as your balances get transferred from multiple banks to just one lender. As a result, your headache of making multiple payments and juggling multiple due dates vanishes. You now just have the one payment, one due date and an incredibly low rate of 0%. Well, the zero percent doesn't last long. Usually after 12-18 months, the rate skyrockets above 20%.

Similarly to a debt consolidation loan, you can expect a loan origination fee. Therefore, tack on another 3-5% to your current balance. Using the same example of $40K in credit card debt, expect your balance to go up to $42,000.

Pros of 0% Balance Transfer

- Instead of 4 payments to make each month, you only have one.

- You have a lower interest rate. You can attack your debt significantly during the 12-18 months

- The balance on your four credit cards drops to zero.

Cons of 0% Balance Transfer

- Your overall total debt amount increases due to the origination fee.

- The APR is temporary, and your rates will increase shortly.

- The root of your problem (overspending) hasn’t been fixed. You may be tempted to start using these cards again. Especially with the balances being zero.

- Requires good credit and bank approval.

- Unlike a debt consolidation loan, a payoff date has not been established.

Advice: Negotiate the origination fee down as close as you can to 1%. Avoid using credit cards in the future. Take advantage of the zero percent and make the largest payments possible to pay off your debt.

Best Companies offering this service: Bank of America, Chase Bank, Wells Fargo, American Express, Citibank

Credit Counseling

Also known as a Debt Management Program, this service hides as probably the least known of the four options. Nonprofit organizations perform Credit Counseling, not the banks. A certified credit counselor reviews all your debts, your monthly income and expenses. Furthermore, they provide you a recommended action plan. In some cases, they recommend enrolling onto their debt management program.

A Debt Management Program will typically reduce your monthly payments and interest rates. In 2024, the average client of DebtWave saw their monthly payment lowered $220 and their interest rates reduced to 6.81%. Unlike Debt Settlement, you pay off 100% of their balance plus minimal interest.

You make one monthly payment to the credit counseling agency via ACH. And they disburse payments to your creditors. The debt remains with your creditors except with a much lower interest rate. Additionally, you will see the balances go down much quicker.

Pros of Credit Counseling

- Instead of multiple payments to make each month, you only have one.

- You typically have a lower interest rate and a lower payment.

- Credit typically remains in good standing as long as payments are made on time.

- Debt usually gets paid off in 3-5 years.

- Receive expert advice on budgeting to help prevent overspending from happening in the future.

Cons of Credit Counseling

- Your accounts are closed and you can’t use the cards enrolled on the program.

- Credit Counseling agencies charge monthly fees

- Combining all your payments into one monthly debit may be burdensome to your budget depending on your payroll schedule

Advice: If you get paid semi-monthly or bi-weekly, ask the agency if they can debit half the payment at a time. This will eliminate the burden of a large amount taken out monthly. Understand that there is about a 10-15 day delay from the time your account gets debited and when your creditors receive the payment. Make sure you keep your accounts current during the enrollment process. And finally, change your due dates to match their schedule.

Best Companies offering this service: DebtWave, Greenpath, Consolidated Credit, Take Charge America

Debt Settlement (aka Debt Forgiveness)

Sometimes referred to as Debt Negotiation or Debt Forgiveness, this earns the award for the most misunderstood of the four options. Debt settlement is the process where a for profit company negotiates the total balance with your creditors. Creditors typically reduce the debt to 30-50% in exchange for a lump sum payment today!

Many people that enroll onto this plan focus on the benefits of the lower payment and quick payoff timeframe. After all, this plan undoubtedly offers the lowest monthly payment of the four options. However, that benefit comes with some headaches. In order for your creditors to reduce the balance owed, you need to fall severely delinquent with your accounts. And we are not talking just a few days delinquent. Unfortunately, you will need to fall months and months behind to the point where your credit score tanks.

Debt settlement also has tax consequences. The amount of debt forgiven will be considered taxable income. You can expect the IRS to come knocking right away. You also have the possibility of getting sued by your creditors which can possibly lead to wage garnishment if the settlement isn’t made in time.

Pros of Debt Settlement Consolidation

- Low monthly payment

- Debt free in 2-4 years

- Pay back less than what you owe

Cons of Debt Settlement Consolidation

- Credit score will get worse

- Tax Consequences

- Possible lawsuits & wage garnishment

- Debt Settlement companies charge fees. Usually between 15-25% of your total debt

Advice: Avoid Debt Settlement unless you can't afford the payment on your own nor can you afford the payment on Credit Counseling. Understand the damage it will do to your credit. Negotiate the companies fees down as close to 15% as you can. Consider doing this on your own.

Best Companies offering this service: Freedom Financial Network, Accredited Debt Relief, National Debt Relief, Pacific Debt

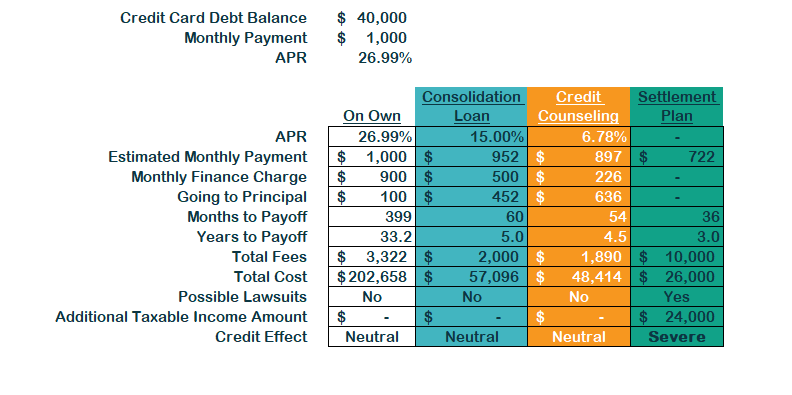

Side by Side Comparisons of Debt Consolidation Plans

When we compare these services, we can assess total costs, fees and years to pay off. Balance transfer is excluded as a payoff plan doesn’t exist with this option. Think of it as more of a temporary solution to lower interest rates. It’s a band aid that doesn’t fix the root of the problem.

Settlement seems the most enticing plan with the lowest months to pay off and the lowest total cost. But buyers beware! The credit effect can be detrimental. And the fees paid to these companies are absurd. Furthermore, the taxable income and potential lawsuits can elevate your financial stress.

Credit counseling typically has the best interest rates and the lowest fees. A debt consolidation loan acts as a great solution as well. Just make sure the credit cards remain dormant, and no additional debt amasses.

Interest in entering your own debt amounts and comparing these services side by side? Download our google sheet. Discover what your estimates would be for each service.

Debt Consolidation

Accordions

You must understand there are four different services for credit card consolidation. Typically, a Debt Consolidation Loan, a Balance Transfer and Credit Counseling all have a neutral effect on your credit score. However, Debt Settlement requires that you starve your creditors of payments. Therefore, Debt Settlement has a severe effect on your credit.

Credit Counseling is a free service that includes analyzing an individual or family’s, liabilities, assets, monthly expenses and monthly income, in order to provide guidance and ultimately recommend an action plan to pay off their unsecured debt.

One of the debt-payoff strategies we recommend is a debt management program (DMP). Our program typically allows the participant to enjoy reduced interest rates, one low monthly payment, and becoming debt free in fewer than five years.

About 68% of the clients that enroll onto a debt management program successfully payoff their debt. The most common reason why some people don't succeed is due to a financial hardship such as job loss or increased expenses.

That's a personal preference. All services (Debt Consolidation Loan, Balance Transfers, Credit Counseling and Debt Settlement) have their pros and cons. It's up to you to figure out what is the best one for your financial situation. Therefore, do lots of research and ask your advisor lots of questions.