With the total credit card debt amount rapidly approaching $1.2 trillion, many consumers are struggling to make ends meet. According to LendingTree, the average household in the United States owes $7,236 – a 38% increase from 2021. The average interest rate on credit cards currently is an ugly 24.26%. When you connect these stats with the fact that millions of Americans pay only the minimum payments each month, climbing out of debt seems nearly impossible for some in 2025. At least trying to do so on your own is.

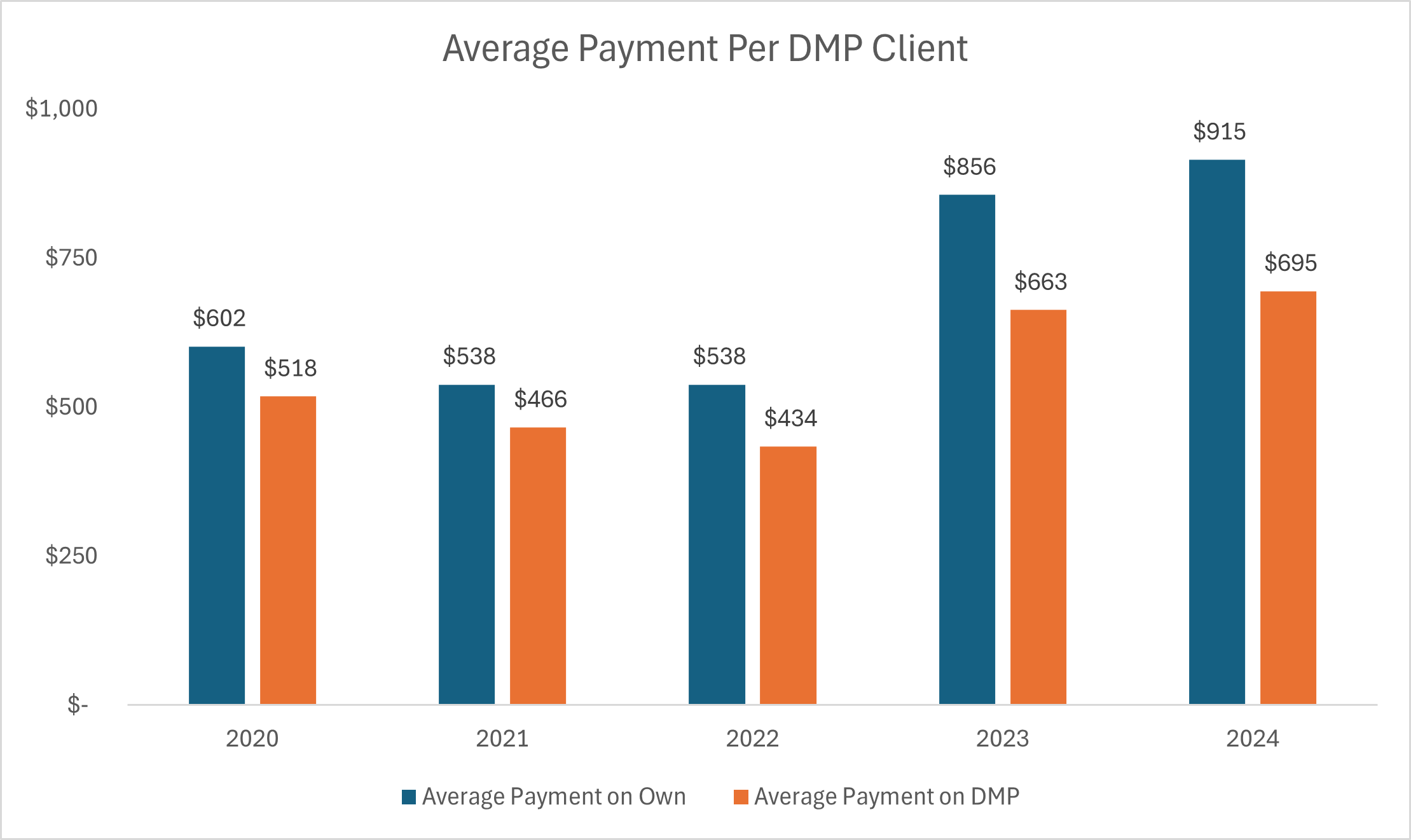

Debt Management Plan Payment Reduction

Luckily, benefits like lower monthly payments and lower interest rates are available through Debt Management Programs. And thanks to record breaking savings at DebtWave in 2024, these benefits make it possible to achieve financial freedom.

Clients that enrolled onto DebtWave’s Debt Management Program (DMP) in 2024 merited an average payment reduction of $220. The average minimum payment plummeted from $915 to $695. This shatters the previous year’s record of a $193 payment reduction.

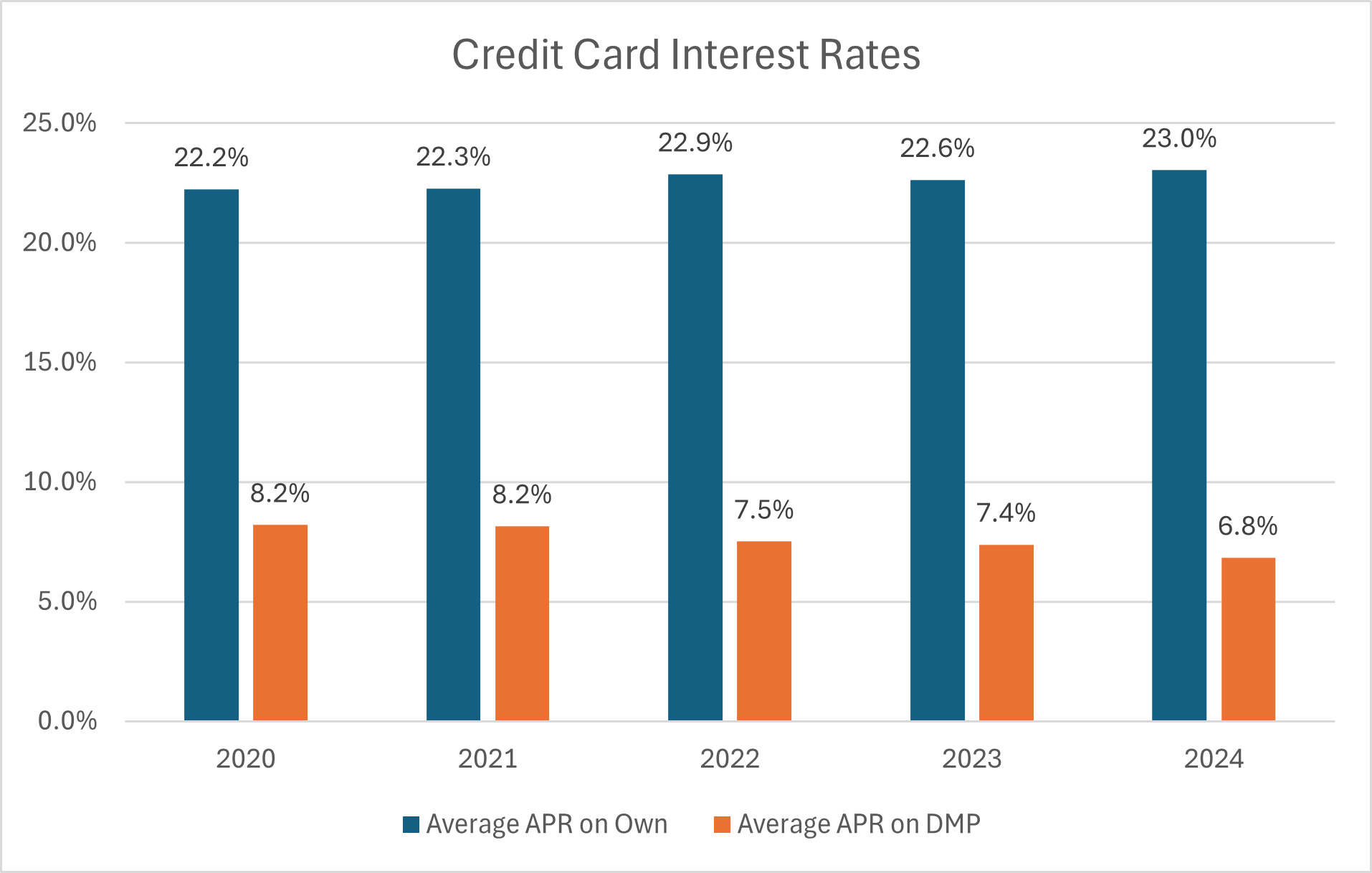

Lower Interest Rates

A big factor that made these savings possible are the attractive concessions offered by the credit card companies. In 2021, creditors wanted about 2.71% of the balance as the monthly payment to enter a DMP. In 2024, that percentage decreased to 2.54%. Additionally, payments on own increased from 2021 to 2024. Creditors required about 3.15% of the balance when making payments on their own in 2021. That percentage increased to 3.35% in 2024.

Credit card companies have been generous with interest rates on DMPs as well. In 2020, the average interest rate obtained on the DMP was 8.2%. In 2024, the average APR dropped to 6.8%, setting a new record at DebtWave. As payments on own increased in 2024, so did the interest rates on own. The average APR per client on own in 2024 peaked at 23%.

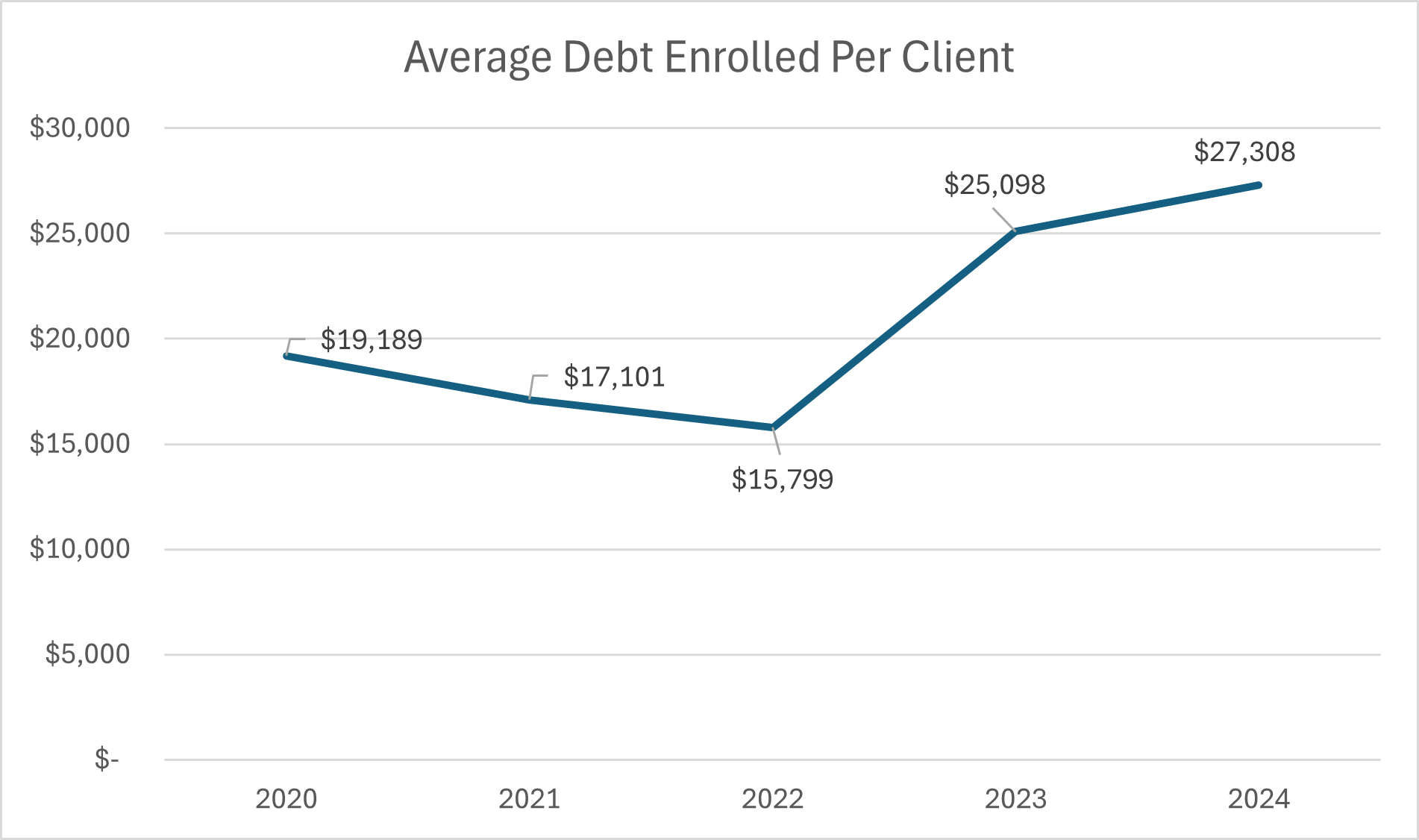

Average Debt Per Client Enrolled

The average balance enrolled per client soared in in the last two years. Another record high established in 2024 with the average surpassing $27,000. This is nearly double the amount of $15,799 in 2022.

Inflation, high cost of living and increased consumer spending have all played a crucial role in the rise of credit card debt. After pandemic restrictions lessened, many people began spending more on non essentials such as travel, dining out, and other activities. This has contributed to higher credit card balances. Tack on high interest rates on credit cards and now it makes it difficult to make a dent in paying it back.

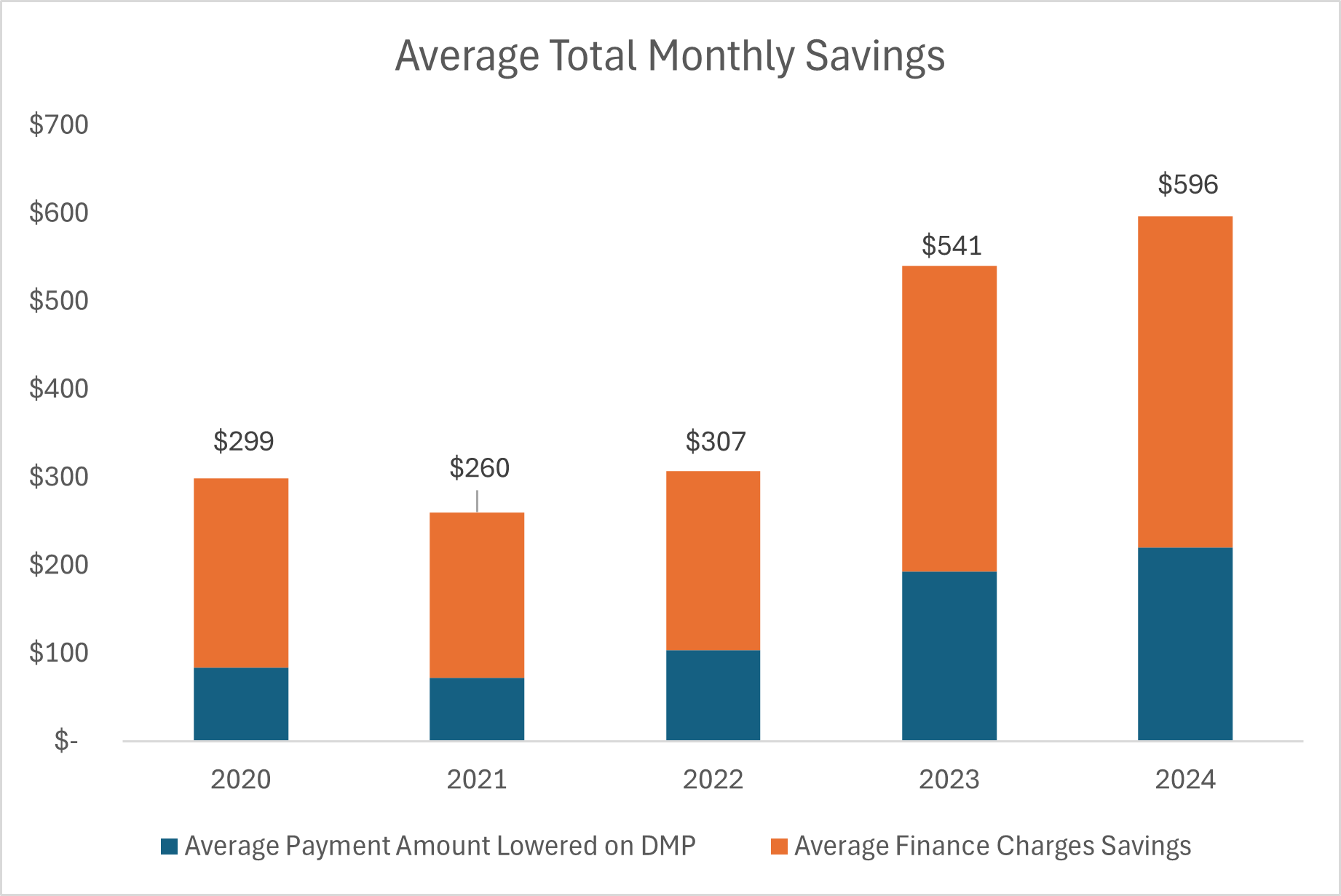

Total Monthly Payment & Interest Savings

When you combine the payment savings and the monthly finance charge savings, you have clients making significant progress to their principal balance. From 2020-2022, the average total combined monthly savings was less than $300. In 2024, the monthly savings nearly doubled to $596.

"After the initial budget review, we see too many clients who are spending more money than they make each month. Hence the large amount of credit card debt", said Michael Marsden, Executive Director at DebtWave. "When clients see their monthly payment dramatically reduced, they feel a great sense of relief. It's great to see clients transition from a negative discretionary income to a positive one."

We expect and hope these incredible concessions to continue in 2025. For those facing high balances on their credit cards and experiencing a financial hardship, help is available. Taking the first step toward financial freedow is the most important step to take. Find more information about credit counseling and our program or get started online.

Accordions

A Debt Management Program can be a fantastic idea if you meet the following criteria:

- Have a large amount of credit card debt ($10K or higher)

- Have interest rates higher than 18%

- Most of your cards are near, at or over the credit limit

- Make only the minimum payment

- Struggle to stick to a monthly budget

- Your accounts are closed and you can’t use the cards enrolled on the program.

- Credit Counseling agencies charge monthly fees

- Combining all your payments into one monthly debit may be burdensome to your budget depending on your payroll schedule

In many cases, the initial rejection of a debt management program by a creditor is fixable. Some of the most common reasons of a creditor rejecting the initial proposal are:

- Creditor wants a higher payment

- Name or SSN on account doesn't match

- Invalid account number

- Account hasn't been opened long enough

- Account is already on a hardship plan

DebtWave has an 85% proposal acceptance rate. The 15% of accounts that get rejected can typically get resolved by sending another proposal.