OneMain Financial is a financial services company specializing in personal loans and optional insurance products. Founded in 1912, it operates approximately 1,400 branches across 44 states, offering both in-person and online lending options. OneMain Financial primarily serves nonprime consumers—those with fair to poor credit. They provide unsecured and secured personal loans ranging from $1,500 to $20,000.

One of the most common reasons for obtaining a personal loan is to consolidate all credit card debt into one payment. In many cases, consumers that watched their debt get paid off through the loan racked their credit card debt up again. If you find yourself in this situation, you certainly don’t stand alone. Personal loans simply shift the balance from multiple creditors to one. Contrary to popular belief, they usually fail to tackle the root of the problem which is usually overspending.

What are your options to pay back your OneMain loan or card debt?

If you find yourself with a pile of credit card debt along with a OneMain personal loan, a hardship program can help. Hopefully, you have learned your lesson and don’t repeat the mistake by getting another loan.

Facing a large amount of debt can be scary. Undoubtedly, it’s a constant reminder that we messed up. And chances are neither your formal education nor your parents prepared you on how to handle this situation.

With the average interest rate currently hovering above 24%, paying off this debt on your own presents a great challenge.

However, there are many debt consolidation options to consider when trying to pay back your OneMain debt. The five main options are:

- Debt Consolidation Loan

- 0% Balance Transfer

- OneMain Internal Hardship Program or Payment Assistance

- Debt Management Plan (Credit Counseling)

- Debt Settlement Plan (Debt Forgiveness)

But the one thing that must be done regardless is putting a stop to overspending. Each time we use a credit card we are likely purchasing something we can’t afford.

Create a detailed budget outlining all income and all expenses. Revisit this budget periodically and make revisions. Increase income. And decrease expenses.

OneMain Financial Hardship Program

If you find yourself struggling with credit card debt, hardship programs can help. In order to find out if you qualify, contact OneMain directly. Provide as many details as possible about your financial situation. Be prepared to provide them with your monthly income and expenses. Stating that you are simply looking for a lower interest rate and payments probably won’t work. You obviously need to have a compelling hardship reason. Without a doubt, job loss or medical emergency are prime examples.

Any concessions granted by OneMain will likely be temporary. A lower interest rate will usually last less than 12 months. Take advantage of that time and attack your debt with extra payments. Some creditors might reduce your credit limit or even close your card once they approve you on their hardship plan.

If you have no luck getting concessions or want more long-term benefits, credit counseling is your next best option. OneMain works incredibly well with nonprofit credit counseling agencies. They reduce interest rates substantially. And payments typically get lowered as well. Your credit card will be closed on their debt management program. This can be viewed as a good thing for some as the temptation to continue using the card is eliminated.

DebtWave has been helping OneMain clients for nearly a decade

DebtWave has worked with various credit card accounts, including OneMain, since 2002 helping clients pay off debt at lower interest rates. Most clients add other credit cards to their plan such as Citibank, American Express and Best Egg accounts. Clients make payments via ACH either monthly, semi-monthly, weekly or biweekly and then DebtWave disburses payments to their creditors. Most clients complete their program and become debt free in less than 5 years. DebtWave has a 68% successful completion rate.

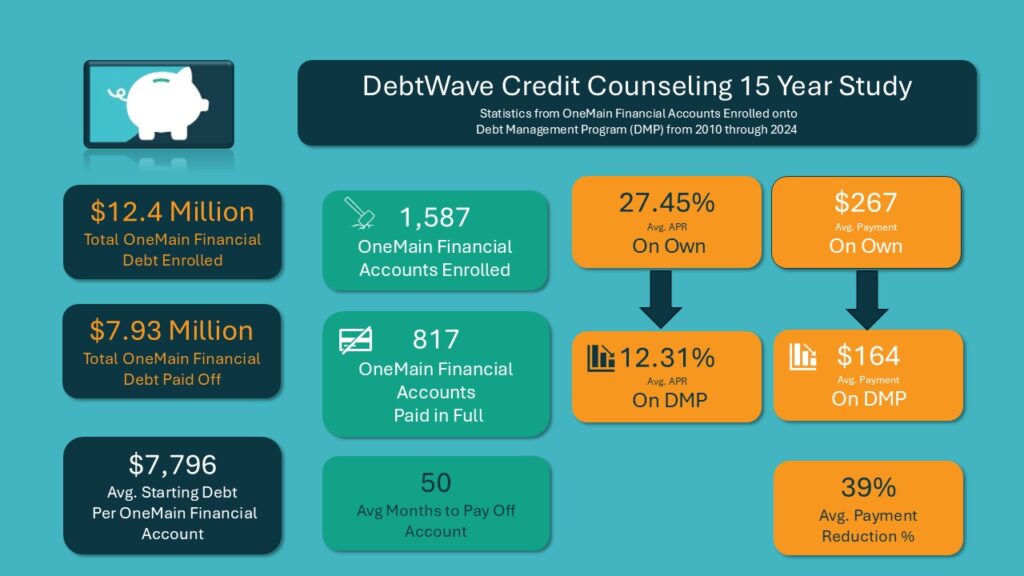

DebtWave conducted a study during a nine year period (2016 through 2024) which they enrolled 1,587 OneMain accounts onto their program. As a result, they discovered that 817 successfully paid their balance in full. And 197 clients are still actively paying down their debt.

Here are some additional stats from these clients:

The Dream of Getting Out of Debt on Your Own is Obtainable

Paying back your credit card debt seems unrealistic. But it has proven to be achievable by thousands of DebtWave clients. If you would rather tackle the debt on your own, it can be achieved. Create your own plan. The first step is lower interest rates. High interest rates (25-30% APR) on credit cards make it challenging to make progress. This would require you to significantly increase your minimum payments (at least 2x).

If you succeed in reducing your rates, then use a payoff calculator or google spreadsheet to create a plan. Find ways to increase income and reduce expenses. Stay motivated and refrain from using cards again. Build an iron clad budget that accounts for all expenses.

Accordions

Most credit card and personal loan companies have an internal hardship program. On a hardship plan, lenders like OneMain will temporarily lower your interest rate for about 3-12 months. Sometimes, they may lower your payment as well. Obviously, your financial hardship must be compelling to qualify for the benefits.

OneMain might be able to lower your payment if you qualify for their hardship program. Credit Counseling (Debt Management Program) has had great success with lower payments with OneMain as well. A recent study shows that DebtWave Credit Counseling, Inc. lowered the average client's payment from $267 to $164. Not to mention, the average interest rate obtained during this 9 year period was 12.31%.

A hardship program through OneMain may reduce your interest rate for a temporary amount of time (3-12 months). Enrolling in a credit counseling program with DebtWave will likely reduce the interest until the account is paid in full.

The only way to get out of a loan with a OneMain is to get another personal loan to pay it off or pay the debt off on your own. Fortunately, Credit Counseling or a Debt Management Program can help restructure the payment and interest terms in your favor.