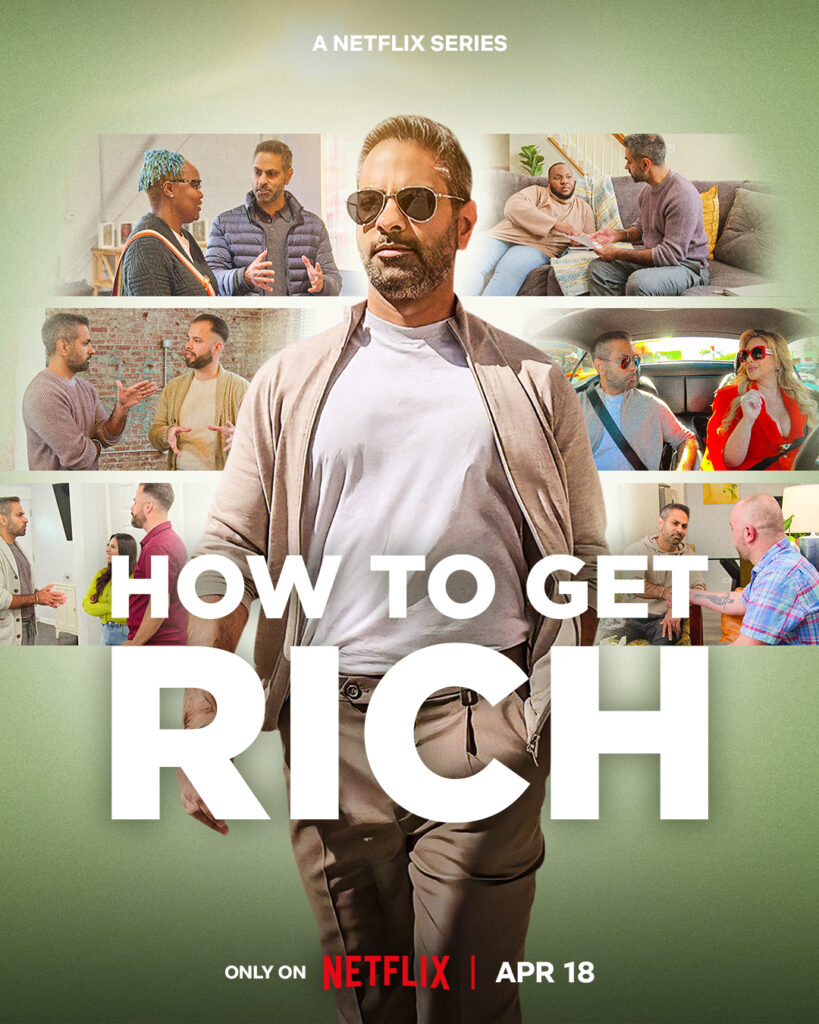

A new docuseries featuring a modern take on how to manage your finances has arrived on Netflix.

In “How to Get Rich,” Americans from all walks of life are asked to open their financial lives for all to see so that they can get personal financial advice from the show’s host Ramit Sethi, author of the 2009 New York Times Best Seller “I Will Teach You To Be Rich.”

In addition to his best-selling book, Sethi, who identifies as a writer and not a classically trained financial advisor, is the founder and CEO of the I Will Teach You to Be Rich website, which reaches more than 1 million people monthly and includes actionable advice on topics related to business, careers, psychology, and you guessed it, money.

You may be wondering: if Sethi is not a financial advisor in the traditional sense, how did he get so involved in financial education? How did he garner such a large following willing to take his money advice?

Sethi’s family is from India, his parents immigrated to the United States in the 1970s. With four kids on one income, Sethi says his parents couldn’t afford to send him to college, so he applied to more than 60 scholarships and ended up earning a full ride to Stanford.

However, Sethi’s inexperience with scholarships and finances, in general, led him to make a costly financial mistake early on. He invested the first scholarship check he got in the stock market and immediately lost half of his money. Sethi says it was after this financial setback that he made a conscious effort to learn how money works. What he discovered was that most financial advice was irrelevant and out of date for most American consumers.

In particular, Sethi found that most financial advice was about restriction, a lot of should not, do not, advice instead of practical tips that most people felt they could accomplish. He also found most financial advice to be confusing, there was no clear direction on where to start managing your money or how to figure out who you could trust when it came to financial advice. And lastly, Sethi found almost no one was talking about the psychology of money and the impact our money mindset has on our ability to save, spend, earn, and invest.

I recently binge-watched Sethi’s Netflix show to see how applicable his financial advice was for not only the show’s participants but for viewers at home. What exactly did I learn from Sethi?

15 Lessons from ‘How to Get Rich’ on Netflix

1. What You Consider ‘Rich’ is Personal to You

When it comes to budgeting, traditional advice is to look at your net income, deduct all expenses, and save whatever is leftover. If you have debt, some of the more old-school financial teachers like Dave Ramsey may even advise you to sell your car, home, or other items to pay off debt and establish a well-funded emergency savings account. But trading in your car for a “beater,” as Ramsey recommends, isn’t necessarily practical for every person or family. Similarly, other financial advice may look like making coffee exclusively at home or eating granola bars and peanut butter and jelly sandwiches while on vacation to save money. But this, again, is not necessarily for everyone.

Sethi’s approach when it comes to budgeting is similar to traditional advice in that he doesn’t recommend spending more than you’re earning, but he asks couples and individuals a question to help frame their spending: What to you is a rich life? What does that look like?

As Sethi explains, for some people, a rich life is having the freedom to pick up their children from school every day. For others, it’s traveling three months out of the year. For someone else, it could be having your dream wedding or buying a house. Whatever a rich life looks like to you should be a priority in your budget. Make spending on those things that allow you to experience your rich life a priority while cutting spending on items that don’t align or are not as important to you.

2. More Money Doesn’t Always Solve Your Problems

Have you ever found yourself thinking that if you just got a $1,000 raise that all of your financial issues would go away only to discover that when you received a $2,000 raise you had more debt and issues managing your finances than you did before?

Lifestyle creep or lifestyle inflation is when our income goes up at about the same rate as our spending. As a result, our finances don’t necessarily reflect an increase in income because we find ways to spend that money on things we convince ourselves we must have: including new wardrobes, homes, and hobbies.

Lifestyle creep is often most noticeable in the lives of those who were already living paycheck to paycheck. A raise may make us feel like we can afford more than we can. In this case, your debt load often increases even though your earnings increased too.

In other words, if you have trouble managing $1,000, you’re likely going to have the same money management issues when you’re earning $10,000 or even $100,000.

3. Simplify Accounts

On the Netflix series, there was a couple that had more than 20 savings accounts and more than 20 checking accounts between the two of them. Plus, they each had multiple credit cards. The couple shared with Sethi that their belief was that the more accounts they have, the more wealth they appear to have. But as Sethi shares, there’s no need to have ten different savings or checking accounts, and it’s flawed logic to believe that the more accounts you have will make it seem like you have more wealth. As Sethi noted, if you have french fries and put some in the bathroom, some in the kitchen, and some in the bedroom, it doesn’t make it appear as if you have more french fries than if you left them consolidated together.

4. Be Careful Splurging on Luxury Items

There’s nothing wrong with buying luxury items – if you can afford them, Sethi notes. If owning luxury items is part of what makes you feel you are living your best rich life, it’s important to budget for the items you want in order to ensure you have the ability to pay for each item in cash so that you don’t fall into debt. The problem Sethi sees is that social media sometimes convinces us that if we buy xy or z item, then our life will dramatically improve or our self-worth will increase, or perhaps we feel that because we worked all week, we deserve this reward. But getting into the habit of splurging on wants vs. needs can be a slippery slope.

He says that this is why he doesn’t believe homeownership is all it’s cracked up to be either and largely recommends renting vs. home buying. Why? Paying a mortgage is the minimum amount you’ll pay each month as a homeowner because you also have to pay property taxes and homeowners insurance, and if there is any sort of repair or maintenance cost, it comes out of your pocket. On the other hand, when you’re renting, your rent payment is usually the maximum you’re paying each month because you’re not responsible for property taxes, and if there is any sort of repair or maintenance required, it falls on the landlord to take care of it.

5. Have the Uncomfortable Financial Discussions

This is more so for those with a partner. Even if you keep your finances separate and pay different bills, it’s important to regularly communicate about money. But for a variety of reasons, many couples avoid having these money conversations because they are frankly uncomfortable. But as Sethi shares, avoiding these conversations won’t make the money issues go away. If you push through the discomfort, you can find resolutions that work for you and your partner.

Even if you are aware of your joint financial situation, other uncomfortable money topics that are important to discuss are long-term and short-term money goals and how you both approach spending, saving, and investing money. Instead of viewing one person as the money manager of the household, view each other as money co-pilots working together from an informed place to accomplish your money goals.

6. Money Lies are Not Simple Lies

Lies about money cut deep. If you’re keeping financial secrets from your partner, it can damage the relationship and lead to divorce. After all, money and financial issues are one of the top two leading causes of divorce and financial lies and financial issues usually start as financial secrets. This means that when you make a financial mistake or if you have debt, you have to be honest with one another. Especially in a partnership, you’re financially tied to one another. As uncomfortable as this conversation may be, your partner may surprise you and help you discover a solution.

7. Learn from Financial Mistakes

Have you ever received a large lump sum of money and spent it all only on frivolous items, only to realize that you should have saved at least a portion of it? Have you made a pledge to never spend hundreds of dollars at brunch ever again, only to repeat this same behavior the very next weekend? Financial mistakes happen, and it’s important not to beat yourself up when you make a financial mistake, but it’s equally important to learn from your financial missteps and not repeat them. If you continue to ignore your bad financial habits and mistakes, you may find yourself getting deeper and deeper into money troubles.

8. Make Financial Decisions when You’re Calm, Cool and Collected

When you make a financial mistake, or you find yourself in a difficult financial situation, pause before making any sort of financial decision. Making financial decisions when you’re in a state of panic or scarcity mindset, you’re more likely to make a financial mistake. If you take the time to catch your breath and calm your nervous system, you may find solutions that you didn’t consider when you were in a state of panic.

9. Budgeting vs. Conscious Spending

While a budget is a helpful tool for figuring out how to save, spend and invest the money you’re currently working with, conscious planning with your money is when you take the time to figure out your long-term and short-term goals, what you hope to achieve, and what it will take financially to get there. Once you know how you want to consciously spend your money, you can adjust your budget accordingly to help you consciously achieve your rich life.

10. People in Debt Avoid their Bills

It’s common to avoid bills when you have debt, but if you’re someone who has stuffed bills in a cabinet or drawer because you didn’t know how to handle the debt, you know firsthand it doesn’t go away if you ignore your financial statements. Ignored debt gets bigger and bigger, so you might as well open it up because then you can come up with a plan to improve your financial situation.

11. Your Childhood Affects Your Future Relationship with Money

If you grew up poor and unable to purchase anything – needs or wants – when you start earning money, you may handle your money wrong. In other words, you may try to make up for lost time by purchasing anything and everything your heart desires. This is because our relationship with money, our money mindset, is largely formed by the time we are seven years old. This also means that if you believe it’s hard to earn money, hard to save money, and that rich people are evil, it will likely affect your ability to earn, save, and live a rich life.

12. Make Sure to Budget for Fun Money

Make sure to give yourself some money to spend on whatever you want, fun money, in your budget. Even if you have debt, fun money allows you to enjoy life and not feel like a prisoner to your debt. It reminds you why you’re working hard to achieve your rich life. If you have a partner, you’ll want to budget for both of you to be able to spend fun money on whatever your heart desires. Make sure to share what you want to spend money on with one another, but understand that what your partner wants to spend their fun money on is not necessarily something you have to agree on. For example, one partner may spend their fun money on investments or building up an emergency cushion, while the other partner may prefer to spend their fun money allowance on guilt-free purchases.

13. Take Advantage of Side Hustles

There’s a limit to how much you can cut from your budget, especially if you’re spending more than you’re earning or you’re on a debt payoff journey. Luckily there’s no limit to how much you can earn. Side hustles are a great way to add additional income to your budget. And the best part about side hustles is that you can find something that works for you. For example, if you have plenty of spare time, you may be able to take on a second job teaching English, mowing lawns, or grocery shopping. But if your time is more limited, you may want to consider something a little less time-involved such as selling digital prints on Etsy or selling an online course.

14. Pay Off Your Student Loans

Did you know that student loan debt can’t be expelled in bankruptcy? In other words, if you fail to pay off your student loan debt, that debt will follow you until the day you die. Sethi met with one individual on the show who didn’t plan to pay off his student loans until Sethi informed him that if you don’t pay your student loans, it will likely impact your ability to buy a home, buy a car, and your wages will probably be garnished.

15. You are Your Number One Investment.

Make sure to save money for your retirement and your future. Sethi shared that people need a reason to pay attention to money, but the biggest reason you should pay attention to your money is because it’s in your best interest, and no one else can do it for you. If your employer has a 401k program, consider contributing to your 401k, especially if your employer offers a matching contribution.

Have you watched ‘How to Get Rich’ on Netflix? What financial lessons did you take away from the show? Share with us in the comments below.