It’s one thing to be on a debt-free journey with your life partner after both of you incurred debt together. It’s a whole different experience though when you’re on a debt-free journey while you’re single and you’re still looking for Mr. or Mrs. Right.

If you’re dating while on a debt-free journey or maybe you’ve already achieved financial freedom, you may have questions about when and how to bring up the topic of money on dates, as well as ask about spending patterns, savings goals, and more. While you may be dying to know if you and your new match are financially compatible, you’re also trying to balance not scaring away your potential match when you mention your financial goals or *gasp* debt.

At least that’s how Dr. Erika Moore Taylor says she felt after she started dating again after paying off $65,000 worth of student loan debt in five years.

Taylor had been living an arguably frugal lifestyle as well as educating herself on budgeting, savings, and long-term financial goals. But now that she was debt-free she felt ready to begin the next chapter of her life and find that special someone to settle down with.

“As I began meeting potential partners, I was worried: Would dating ruin my long-term financial plans? Fog up my financial clarity? Disrupt the budgeting habits I’d developed while paying off my loans?” Taylor recalled.

Taylor isn’t alone in her fears related to debt and dating. As it turns out, nearly 3 in 4 American adults, 72 percent, reported debt as a relationship deal-breaker, according to a survey from Finder.com.

For Taylor, she knew her future partner would have to be on board with her new debt-free lifestyle. But she still wondered how she was supposed to talk about money and her future goals in a way that didn’t turn off her potential dates.

Cost of Dating

The average cost of a U.S. date— in the form of dinner for two, a bottle of wine, and two movie tickets — was around $102.32 in 2018, according to online dating giant Match.com. But of course, most of us don’t just go on one date each year. Over the course of a year, the average single American spends about $1,596 going out on dates, according to Match’s annual survey of more than 5,000 people.

The most expensive cities when it comes to date night? New York topped the list with the average date night out costing $297.27, followed by New Jersey where the average date night costs about $259.60. Hawaii and Connecticut were close behind.

In California, the average date night costs about $226.35 compared to $109.81 in my home state of Minnesota. South Dakota came in as the least expensive date night, with an average date night cost of just $38.27. North Dakota, Nebraska, and Iowa were runner-ups for least expensive.

For Taylor, who self-identifies as frugal, spending money on a date, including a first date, often made her anxious. Even when she met her now-husband Brandon for a first date at a movie theater, Taylor wasn’t sure what her date expected from her financially, which left her unsure if this match would last.

“[Brandon] offered to pay for the movie tickets,” Taylor recalled. “Right away, I was conflicted.”

“On one hand, I was happy because he offered to pay. Since I’m frugal, I saw it as a free movie (win!). I was worried, though: What did he expect me to contribute? Would I have to pay for the next meal? The ambiguity left me concerned, and I didn’t like either of us spending money on each other without a clear set of expectations.”

Despite her date’s insistence that he would pay for the movie and snacks, Taylor paid for the peanut M&M’s at the concession stand since her date bought the movie tickets. “I decided that establishing the precedent of equal contribution upfront was more important than going along with what we’d been socialized to see as normal,” Taylor said.

“To me, expecting him to pay for everything would put an unfair financial burden on Brandon, especially when we hadn’t even talked about budgeting or income yet.”

Discussing Money on a Date

While a lot of us may put pressure on ourselves to impress and wow a potential romantic partner on a first date, many dating experts and financial advisors recommend you keep the first date as simple as possible. So instead of a fancy dinner at the hottest restaurant in town, perhaps you grab a cup of joe or a smoothie instead.

“Scheduling a 30-minute coffee date gives you enough time to get to know your match before deciding if [she or] he’s worth another meeting,” Dandan Zhu, owner of the recruitment firm DG Recruit told the New York Post.

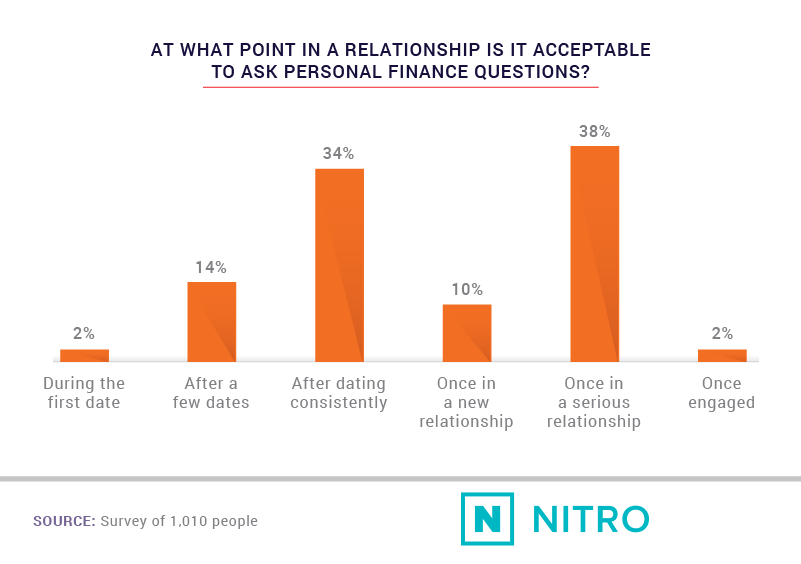

And as Taylor learned, there are ways to ask someone early on in your relationship about how they manage, save, and spend their money without coming across as too forward or bold.

For example, on a first date, she may ask: “Where do you like to eat? What do you enjoy doing?” Taylor says this gives you an idea of someone’s attitude toward money. Are they always spending or do they save?

“By the second date, we were focusing a bit more,” Taylor said. She asked her date questions like ‘What do you want your life to look like? Or what are you looking forward to?’ and says the answers to these questions revealed whether her future outlooks and desired lifestyles were compatible with her dates.

“Then came the differences: I would never pay $100 for a piece of meat, and Brandon thought it was fine to pay top dollar for a luxury restaurant meal from time to time,” Taylor said. “I have never played a video game, so I could not relate to spending money on a gaming console — but Brandon could.”

Although not all of Taylor’s dates appreciated her upfront attitude related to money, in the end, it worked out for her.

I knew finding the right partner wouldn’t be simple,” she says. “Paying off debt had forced me to reach a new level of financial awareness. As I thought about dating, I imagined finding someone who was just as excited to talk about money as I now was,” she said. “I was ready to translate all I had learned about budgeting and saving into long-term investments and plans for my future.”

As it turns out, one of Taylor’s most treasured memories of dating her now-husband was when they had the “Debt Talk.”

“After a hilarious conversation (and considerable dodging), I learned that Brandon had over $35,000 in student loans. Combined with the $65,000 I had just paid off, we had taken out over $100,000 in student loans for our education,” Taylor said. “Did I really want to go back to being in debt?”

While Brandon’s student loans were nerve-racking for Taylor, she decided that making her and Brandon’s relationship a safe space for money talk was more important than finding someone who was debt-free.

“At the end of this conversation, the loans no longer held shame,” Taylor said. “They were just something Brandon was working toward eliminating, and if we were to continue our relationship, they would become an area of focus. But more importantly, I knew Brandon was my partner when he had an open and honest reaction to all of my money questions,” she said. “In some ways, you could say that the ‘Debt Talk’ brought us together.”

Dating with Debt

Dating when you have debt can be challenging for a few reasons. Arguably one of the biggest challenges is related to the fact that money is responsible for a majority of divorces in the United States. And these money divorces don’t always happen because someone went out and spent money; sometimes it’s a result of paying hundreds towards debt every month and feeling like you’re not making any progress, feeling like you’re living a life that you didn’t sign up for.

Take Becky Beach for example. The 37-year-old was engaged to a well-dressed business analyst who drove a fancy car, who only confessed when the couple was house-shopping that his credit was poor and he owed more than $150,000 in credit card debt. Beach returned the diamond engagement ring and ended things.

Beach is not alone in having a relationship end after discovering their partner was not being truthful about their finances.

Leslie Tayne, a financial attorney and the author of “Life & Debt,” called off her own earlier engagement over money issues. The person she was dating at the time “had a good job, he owned a home, but he was unwilling to share the details of his finances,” she said. “That was a big red flag for me.”

“I’m not a fan of secrets in a relationship,” Tayne added. “If you are going to get married, it’s important to be open and forthright.”

While honesty may be one of the top qualities we look for in a partner, that hasn’t stopped everyone from continuing to fudge their numbers.

Roughly 3 in 10 Americans admitted to lying about their salary, while more than 1 in 4 said they’ve hidden the truth about their spending habits, according to a recent survey of 2,000 adults, by Self Lender, a credit-building loan app.

In 2 out of every 5 couples, one spouse admits to lying to his or her partner about money, according to a separate survey by the National Endowment for Financial Education. In addition, 75 percent of those surveyed said financial deception has adversely affected their relationships.

Additionally, a previous survey of more than 1,000 borrowers found that 43 percent of respondents said they fight about money “somewhat often” with their partner. Others take a nondisclosure route: 24 percent of those surveyed said they’ve kept their student loans a secret from their partner, and 18 percent said it’s okay to lie to a partner about money.

Financial Infidelity

These days, significant debt is harder to avoid, particularly among those just starting out.

A typical millennial living in the city carries a hefty debt load — about $23,064, according to a LendingTree study — mostly due to record-breaking student loan balances, sky-high rents, and car loans.

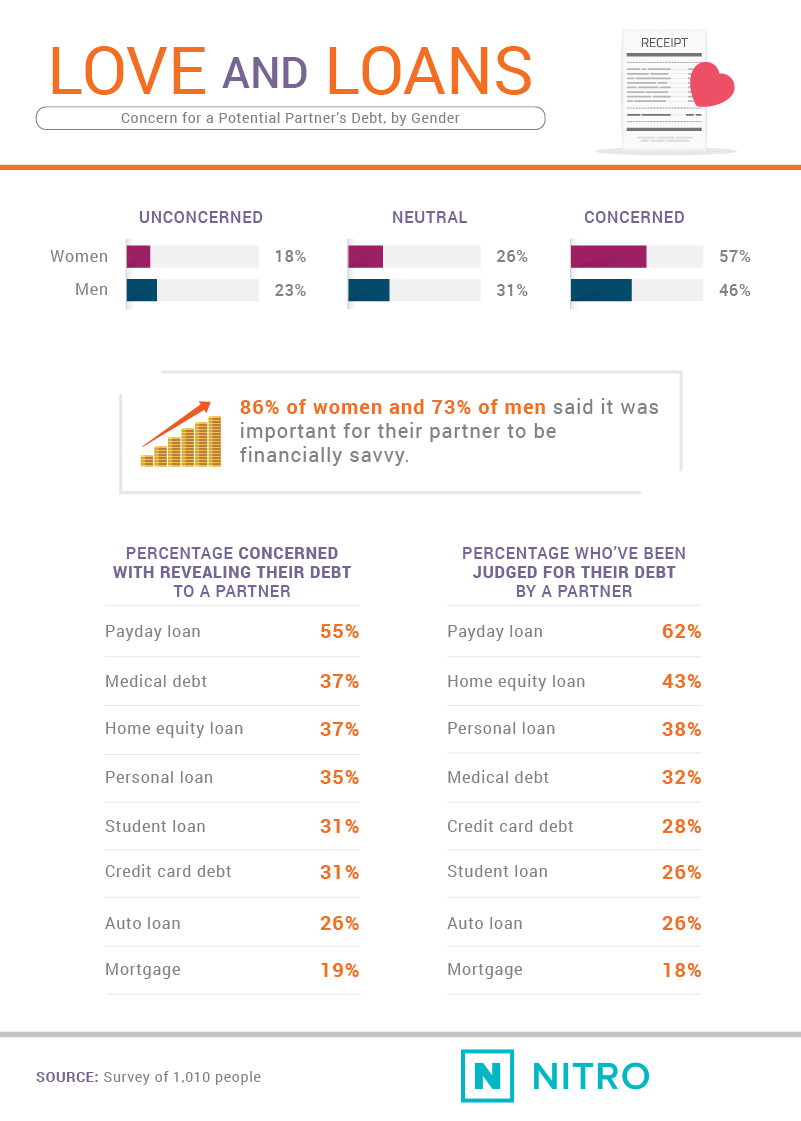

Yet the majority of both women (57 percent) and men (46 percent) reported they are concerned about their potential partner’s debt.

“Almost everybody has debt,” says Tayne. “The problem is that not everybody is open and willing to share that.”

Almost everybody has debt and 3 in 4 Americans are looking for a romantic partner who doesn’t have debt, according to a survey from Finder.com. According to the website, disqualifying a potential suitor due to their debt could shrink your “pool of potential matches by roughly 182.8 million adults.”

Not All Debt is Created Equal

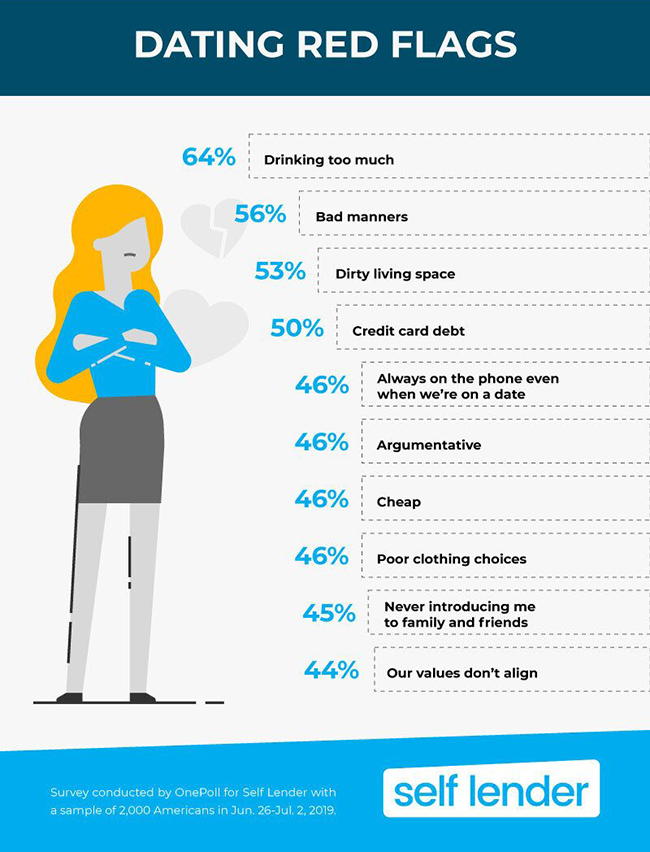

When it comes to dating and even in marriages, there appears to be a hierarchy of acceptable debt. According to Self Lender’s survey, more than one-third of respondents think credit card debt is worse than student loan debt — and credit card debt over $10,000 is considered a major red flag in relationships.

In fact, credit card debt only ranks behind drinking too much, bad manners, and living in a dirty space as the biggest dating deal breakers.

Student loan debt is becoming increasingly accepted as 7 in 10 seniors graduate with debt, owing about $30,000 per borrower, according to the most recent data from the Institute for College Access & Success. Still, student loans are cited as a contributing factor in about one-third of divorces.

“According to a study by Student Loan Hero, a website for managing education debt, more than a third of borrowers said college loans and other money factors contributed to their divorce,” Jen Rogers explained on the Final Round. “In fact, 13 percent of divorcees blamed student loans, specifically, for ending their relationship.”

“I’m surprised it’s not higher,” Yahoo! personal finance expert Jared Blikre added. “Because when I looked into this report, it’s amazing. It says the average outstanding balance is currently $34,000. That’s up 62 percent over the last decade. In addition, the percentage of borrowers who owe $50,000 or more has tripled over the same period.”

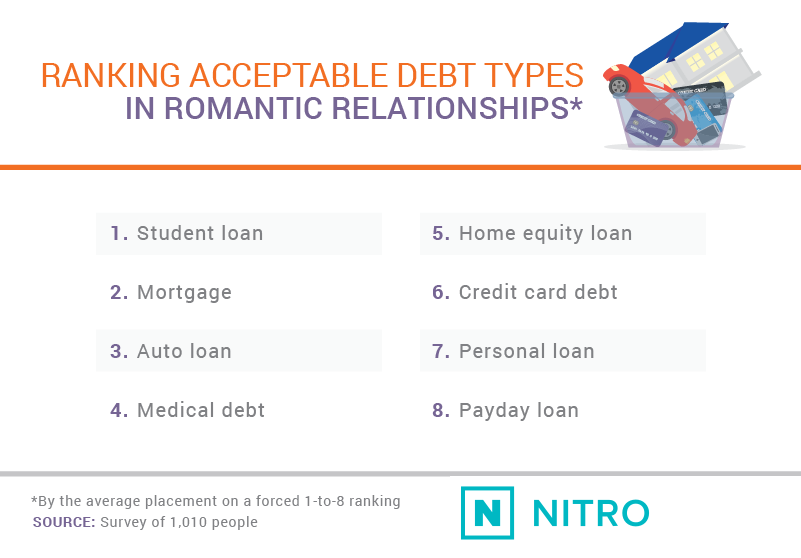

In other words, the prevalence of student loans, and the important role they play in helping millions achieve their education goals, might be why this category of debt was the most acceptable type in romantic relationships. But it’s still not a guarantee that money issues won’t lead to the demise of your relationship.

Mortgages, which are generally understood to be good debt (meaning the loaned funds are used to buy something that should appreciate in value), were the second-most acceptable type of debt, followed by auto loans and medical debt.

Payday loans, in particular, were a notable concern among respondents: 55 percent were worried about revealing this type of debt to their significant other, an unease that may be explained by another 62 percent who felt they were judged by a partner for having that particular kind of debt.

How common are payday loans in the dating world you ask?

Around 2.5 million American households rely on payday loans every year to bridge their financial gaps, with $350 being the average payout. While the companies that dispense these loans are supposed to be used for emergencies, they are most frequently used to cover recurring expenses like bills, rent, and food.

Disclosing Your Debt Load

Love isn’t all roses and champagne, sometimes it’s honesty and a willingness to improve yourself – and not only for your sake but for the benefit of your partner. While debt and finances may not be the sexiest topic to discuss, if you’re going to have a long-term relationship with this person, you’ll need to be able to talk about money openly without judgment or fighting.

If you have debt, consider sharing with your partner:

What kind of debt(s) you have

Be prepared to discuss the type of debt, such as credit cards or personal loans, and be ready with the numbers to give your partner a good idea of where you stand.

How you accumulated your debt

And, if you feel comfortable doing so, you can explain the circumstances behind why you owe money.

And how you’re paying it off

Avoid being defensive about your debt or painting it in an overly negative light as though you’re ashamed of what you owe.

How your partner responds is going to be very telling. For example, are they supportive of your work to improve your financial situation? If you’re going to have a future together, it’s important that when things get hard, your partner doesn’t just walk away. In most cases, if you show that you’re serious about taking responsibility for debt payoff and you have a solid plan for getting your financial life in order, your partner should be understanding.

Remember, you’re not just disclosing your debt so that you don’t end up in a situation where you’re asked to spend more than you can; it’s also about being honest and transparent with your partner. If you wait too long to bring up your debt or if you’re too secretive, your partner may end up feeling betrayed and may perceive your debt to be more problematic than it is.

It’s possible your partner may deem your debt problematic and end things, hopefully, this happens before your relationship progresses too far along.

It’s also possible you may learn your partner has a debt of their own they’re working hard to pay off. Wouldn’t that be a relief to find your financial soulmate?