Seeking Debt Relief with CareCredit can be easy!

Not too many people include vet bills or dental work into their regular monthly budget. After all the dentist or the vet are two places that nobody likes or expects to visit. We don’t plan on the dog getting sick or having a toothache. But when it happens and funds are tight, that’s where CareCredit comes to the rescue.

CareCredit is a healthcare-specific credit card designed to help people pay for out-of-pocket vet bills or dentist bills. And by “help”, we mean pay it later with lots of interest added. It's accepted at over 260,000 locations nationwide, including doctors, dentists, hospitals, veterinary clinics, and select retail locations like Walmart and Walgreens. Synchrony Bank issues CareCredit cards. They rank in the top ten in Credit Card Market Share by Cards in Circulation.

What are your options to pay back your CareCredit card debt?

Facing a large amount of credit card debt can be scary. Undoubtedly, it’s a constant reminder that we messed up. And chances are neither your formal education nor your parents prepared you on how to handle this situation.

With the average interest rate currently hovering above 24%, paying off this debt on your own presents a great challenge.

However, there are many debt consolidation options to consider when trying to pay back your CareCredit card debt. The five main options are:

- Debt Consolidation Loan

- 0% Balance Transfer

- CareCredit Internal Hardship Program

- Debt Management Plan (Credit Counseling)

- Debt Settlement Plan (Debt Forgiveness)

But the one thing that must be done regardless is putting a stop to overspending. Each time we use a credit card we are likely purchasing something we can’t afford.

Create a detailed budget outlining all income and all expenses. Revisit this budget periodically and make revisions. Increase income. And decrease expenses.

CareCredit Card Hardship program

If you find yourself struggling with credit card debt, hardship programs can help. In order to find out if you qualify, contact CareCredit directly. Provide as many details as possible about your financial situation. Be prepared to provide them with your monthly income and expenses. Stating that you are simply looking for a lower interest rate and payments probably won’t work. You must have a compelling hardship. Without a doubt, job loss or medical emergency are prime examples.

Any concessions granted by CareCredit will typically be temporary. A lower interest rate will likely last less than 12 months. Take advantage of that time and attack your debt with extra payments. Some creditors might reduce your credit limit or even close your card once they approve you on their hardship plan.

If you have no luck getting concessions or want more long-term benefits, credit counseling is your next best option. CareCredit works incredibly well with these nonprofit organizations. They reduce interest rates substantially. Payments typically get lowered as well. Your credit card will be closed on their debt management program. This can be viewed as a good thing for some as the temptation to continue using the card is eliminated.

DebtWave has been helping CareCredit & Synchronry Bank clients for more than 20 years

DebtWave has worked with various credit card accounts, including CareCredit, since 2002 helping clients pay off debt at lower interest rates. Most clients add other credit cards to their plan such as Chase, Synchrony and Citibank accounts. Clients make payments via ACH either monthly, semi-monthly, weekly or biweekly and then DebtWave disburses payments to their creditors. Most clients complete their program and become debt free in less than 5 years. DebtWave has a 68% successful completion rate.

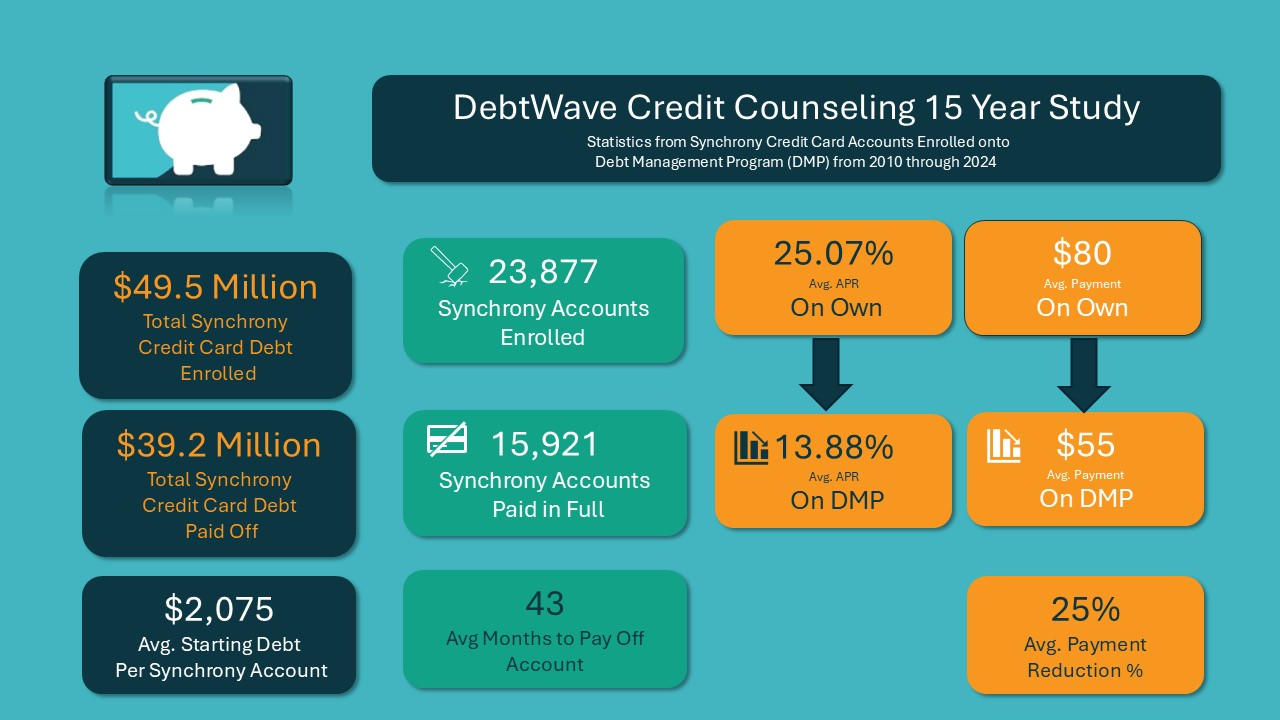

DebtWave conducted a study during a fifteen year period (2010 through 2024) which they enrolled 23,877 Synchrony accounts onto their program. As a result, they discovered that 15,921 successfully paid their balance in full. And 1,989 clients are still actively paying down their debt.

Here are some additional stats from these clients:

The Dream of Getting Out of Debt on Your Own is Obtainable

Paying back your credit card debt seems unrealistic. But it has proven to be achievable by thousands of DebtWave clients. If you would rather tackle the debt on your own, it can be achieved. Create your own plan. The first step is lower interest rates. High interest rates (25-30% APR) on credit cards make it challenging. This would require you to significantly increase your minimum payments (at least 2x) to make progress.

If you succeed in reducing your rates below 10%, then use a payoff calculator or google spreadsheet to create a plan. Find ways to increase income and reduce expenses. Stay motivated and refrain from using cards again. Build an iron clad budget that accounts for all expenses.

Accordions

Most credit card companies have an internal hardship program. On a hardship plan, banks like CareCredit (Synchrony Bank) will temporarily lower your interest rate for about 3-12 months. Sometimes, they may lower your payment as well. Obviously, your financial hardship must be compelling to qualify for the benefits.

You must have a legitimate financial setback such as loss of income, job loss, medical emergency or a major increased expense. Credit card companies will likely ask details about other expenses such as rent, food and utilities. In this case, be sure to have your budget detailed and available to share.

Simply telling them you need lower interest rates and payments likely won't help you qualify. Therefore, be prepared before calling them.

Care Credit (Synchrony Bank) does not perform credit counseling in-house. However, Synchrony Bank works with various nonprofit credit counseling organizations. They offer concessions to these agencies' clients such as lower interest rates and lower payments. In most cases, clients combine their Synchrony credit cards with other credit cards to pay off all their debt.

Most credit card companies do not have a formal forgiveness program. In order for a creditor to forgive a portion of your debt, you would need to be severely delinquent. Usually more than 6 months behind where your credit is ruined. At that point, most creditors would be willing to receive a lump payment of 40-60% of the balance and forgive the remaining balance. However, the amount forgiven would typically be considered taxable income by the IRS.