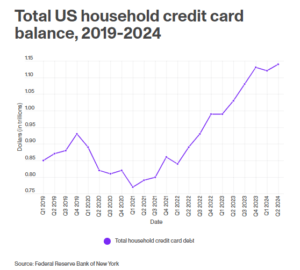

After a brief payoff period during the COVID-19 pandemic, powered mainly by stimulus checks, American consumers are increasingly struggling with credit card debt.

According to the Federal Reserve Bank of New York’s Center for Microeconomic Data’s Quarterly Report on Household Debt and Credit, released in August 2024, credit card balances increased by $27 billion in the second quarter of 2024 to $1.14 trillion. And the percentage of households holding an unmanageable debt increased from 26 percent to 28 percent.

In other words, an increasing number of Americans are not only struggling with outstanding debt, but the cost of this debt has also increased, leading to more than one-third (36 percent) of U.S. adults owing more in credit card debt than they currently have in their emergency savings.

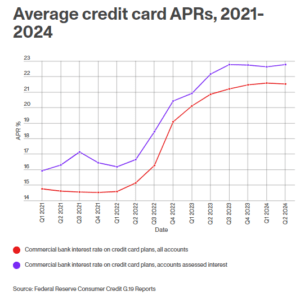

Credit card APRs increased by 30 percent in 18 months to the highest interest rates in history, rendering monthly payments less productive and eating away at consumers’ budgets more than ever before.

While credit card debt is just one type of debt we face in our lifetimes, along with mortgages, car loans, student loans, and medical debt, credit card debt has a different stigma compared to other forms of debt.

Having a credit card isn’t bad in itself, especially if you can pay off your balance every month, the perks and points can be quite rewarding. However, credit card debt is uncomfortable to share; it feels shameful and taboo. Credit card debt is also comparatively easy to obtain compared to other forms of debt.

Credit cards are “easy,” says LendingClub Chief Customer Officer Mark Elliot, and that’s part of the problem.

“Credit cards are wonderful from a convenience perspective, but if you use them as a loan, you really need to know how to manage them,” Elliot says. “Unfortunately, consumers are still not at a place where they’re really using them as wisely as we would like to see.”

Credit cards are highly profitable for lenders because APRs and interest rates are hard for us to wrap our heads around. “Most financial costs don’t have visible price tags,” Morgan Housel writes in his 2020 bestseller The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness.

America’s Credit Card Debt Epidemic

One issue many financial educators see with credit cards in the United States is that many consumers don’t know the proper ways to use a credit card.

Credit cards can be a beneficial financial tool if you pay off your balance every month, as benefits like cash-back rewards, travel points, etc., can stretch your budget further. However, financial educators say many consumers don’t understand how minimum credit card payments work, and the confusion around minimum payments often results in consumers racking up credit card debt faster than they realize.

“I think there’s confusion around what a minimum payment does,” says Nikki Macdonald, a certified financial planner at Northwestern Mutual. “People are like, ‘Oh, I always pay my minimums,’ as if they’re telling me ‘No, I’m good.’ I’ll show you the calculation of how long it’s going to take to pay that off — it’s not good.”

Stacey Black, lead financial educator at not-for-profit credit union BECU, agrees. “This happens to a lot of people.”

Black says the solution starts with education; she teaches financial literacy classes to high school and college students and sees firsthand how young people are often tasked with making important money decisions without understanding the fundamentals of debt collection.

“When I was 18, I had no clue. I went to the mall and got a credit card, used it, charged it to the limit, then got another one,” Black says. “I did not understand the impact that would have on my financial future.”

She says that by being open and honest in class about the mistakes she’s made, she gets a lot of people to also share their individual stories, although “they’ll wait until after class, and then come up to me and say ‘this is my situation.'”

Black says that when she asks students who already have a credit card how they got it, they say their parents gave it to them, and that “they have no clue” how to manage it.

Not only are consumers a little fuzzy on how credit cards work, financial educators also point out how many of us are unaware of how our emotions affect our use of credit cards, and how advertisers use sophisticated strategies to prey on our emotions and get us to spend with just a single click, tap, or scan.

Credit Cards are Not the Same as Cash

Studies have shown that our brain reacts differently when we pay with cash versus credit cards. People experience something that can be interpreted as pain when paying with cash.

It’s imperceptible most of the time but it’s there.

Ever cringe when you see the price tag for something? Paying with plastic doesn’t trigger that same physical response. That makes it easier to charge away.

Plus, the mere anticipation of using a credit card for a purchase activates the reward network in our brains, according to a 2021 study published in Scientific Reports.

Researchers did brain scans of subjects as they considered buying Xbox controllers. What they found was a strong “step on the gas” correlation; the opportunity to pay with a credit card-powered repayment plan was exciting and anticipatory for the brain, releasing dopamine. In this way, the neurochemistry behind using a credit card is similar to that of amphetamines.

Not only does our brain flood with feel-good chemicals at the thought of making purchases with our credit card, but spending money can also help us soothe our pain, temporarily, says Traci Williams, a board-certified psychologist and certified financial therapist.

“Overspending can serve as a coping skill. It’s an unhealthy coping skill with potentially long-lasting negative consequences, but a way to cope nonetheless,” Williams says.

Credit card balances have become our emergency funds

There’s another reason credit card debt continues to increase: Credit cards have become the new emergency fund.

Many people lean into credit cards for emergency expenses not because they want to, but because they have to. About 55 percent of Americans live paycheck to paycheck, 36 percent have more credit card debt than emergency savings, and 22 percent have no emergency fund at all.

When you need extra cash for an emergency and don’t have it, credit cards and personal loans are the fastest way to cover unexpected costs.

Ian Group, a current personal finance creator and former lawyer, found this out the hard way.

“I figured I would come out of law school, make a lot of money and the loans wouldn’t be a big deal,” he said.

Although he graduated at the top of his class, he also had $190,000 in student loans, and could only land a clerkship with a $50,000 salary. This left little wiggle room for emergencies, let alone making full loan payments.

“Things just came up, which I think resonates with a lot of people who are in credit card debt,” he says.

Since all his monthly income went toward living expenses, setbacks like car troubles were financed with a swipe, and Group soon racked up $20,000 in credit card debt. He also took a forbearance on his student loans during his clerkship, which paused his payments, but interest kept accruing. His student loan debt grew faster, reaching $210,000 at its peak.

“I felt really sick when I saw that,” he says. “I should have paid more attention, because those decisions had a big ripple effect on my future.”

If we don’t have much in savings, we’re more likely to lean into credit cards and carry higher-interest balances when budgets are strained. Current credit card provider APRs make this strategy more treacherous.

When inflation hit a 40-year high in 2022, the Federal Reserve stepped in to try to slow down the economy. The central bank raised rates 11 times, driving up the cost of borrowing.

Anytime the Fed raises rates, a credit card provider will raise interest rates on credit cards. As a result of the Fed interest rate increases, average APRs have spiked to over 20 percent, a 30 percent increase over the last year and a half, with retail card APRs at nearly 29 percent.

Fed officials think they’ll be able to cut borrowing costs eventually this year, but they’re cautious about giving the financial system more gas, too soon.

The Fed is unlikely to cut borrowing costs aggressively, even when the time for cheaper interest rates does come. How long the Fed decides to keep rates high will have major implications for every financial decision consumers make, as the higher interest rates make big-ticket purchases like mortgages, car loans, and credit card debt, even more burdensome.

Since most credit cards have a variable interest rate, there’s a direct connection between the Fed’s benchmark and the interest you pay on your credit card. In other words, as the federal funds rate rises, the prime rate increases as well, and credit card rates follow suit within one or two billing cycles.

If you are struggling to pay off high-interest credit card debt, now is the time to work on lowering your debt balances by contacting a nonprofit credit counseling organization like DebtWave Credit Counseling.

You can start your journey to financial freedom online or contact one of DebtWave’s certified credit counselors for a complimentary budget analysis here.