Trying to pay your monthly bills with a bi-weekly pay schedule can be challenging. Your paydays fluctuate each month, but your creditors always want their money on the same day. This seemingly harmless pay schedule can leave many wracking their brains and pulling their hair, wondering why they can’t seem to pay their creditors on time each month.

Does this sound familiar to you?

How to Juggle Monthly Bills with Biweekly Paychecks

Remember a budget is essentially a financial roadmap for what you want to do with your money. Even if you’re paid on a biweekly schedule, it is possible to create a budget that works for you and your family.

Below are five tips to help you end the madness and keep current with your monthly bill payments:

1. Lose the “Extra Paycheck” Mentality

Yes, it’s true – there are two months each year where you will get three paychecks in one month, but that doesn’t mean that you get to throw a big party or go on a massive shopping spree with this “extra” money. Typically, people who have this mentality end up paying their next set of bills late. This causes a chain reaction and the next month’s bills are late, too.

2. Pay Your Mortgage Bi-Weekly Instead of Monthly

For those who own a home, our mortgage payment is usually the largest bill that we have each month. High housing costs are increasing throughout the U.S. and leading to a lot of financial insecurity. When we make our entire mortgage payment from one of our bi-weekly paychecks, there’s usually not much money left over. Living on nothing for two weeks is certainly not fun, so consider taking half of your mortgage payment from each paycheck.

Contact your lender and see if they allow you to make bi-weekly payments. Don’t send in partial payment unless they approve it. Most lenders will return payments if they are less than the total amount due.

If your lender allows less-than-full payments, you may find you’re paying off your mortgage more quickly than you once imagined. After all, you’ll be making 26 half-payments per year (13full payments) versus the 12 monthly payments. You also pay more toward the principal and less in interest.

If you are unable to set up bi-weekly payments to your lender, another idea is to take half of your mortgage payment from each paycheck and transfer it to your savings account. Transferring it out of your checking account into savings can help prevent the temptation of spending the money on something else. When your payment comes due, transfer the full mortgage payment amount back into your checking account and make the payment by the due date. Check with your bank to limit any transfer fees they may have. If you rent, the same plan applies; however, there is no interest to save.

3. Pay Your Bills Early

Don’t be afraid to pay your bills early. If you got paid on the 9th and the bill isn’t due until the 20th, go ahead and pay it on the 9th. There’s no need to wait until the 20th to make a payment. If you wait until the 19th or 20th to pay it, you are giving yourself 10 days to possibly spend that money on something else.

Paying your bills as soon as the money comes into your account will prevent you from wasting money on other non-necessities. This is especially true when they are payments, such as credit cards or car payments, that accrue interest. If balances are being carried, then interest compounds every day. Paying earlier allows you to pay less interest and pay off your cards faster.

4. Get Organized: Create Two Separate Bi-Weekly Spending Plans

Creating a spending plan is without a doubt one of the most useful tools that you can use to help you achieve your financial goals. Most of the time, individuals create a monthly spending plan, which is great, but when you get paid bi-weekly, the monthly spending plan can be difficult to follow. Instead, create a different spending plan for each alternating paycheck.

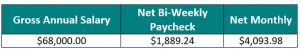

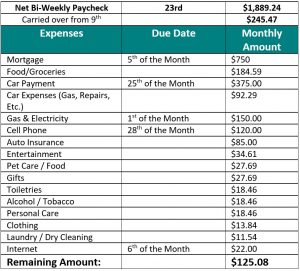

Let’s use the example below and convert the monthly spending plan for this family of two into a bi-weekly spending plan. (The example below is after taxes and other deductions that come out of your paycheck).

As you can see from the Net Monthly Income of $4,093 and the Total Monthly Expenses of $3,712, this couple shouldn’t have any problem living within their means each month. They should actually be able to put $300+ in savings every month.

The challenge this couple may have each month is the large mortgage payment ($1,500) eating up most of a bi-weekly paycheck ($1,889). If they don’t plan properly, they are left with less than $400 for two weeks. And with four other bills due right around the same time of the month, this could set up a potential disaster.

A bi-weekly spending plan can help prevent these mistakes.

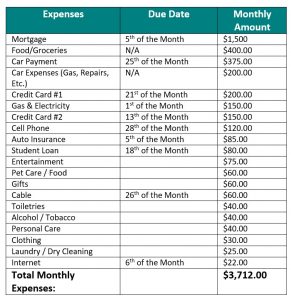

In setting up your spending plan, you’ll need to account for all expenses during that two-week period. Let’s say it’s the 1st of the month and their next two paychecks are scheduled for the 9th and the 23rd of the month. We will also assume that all bills have already been paid through the 9th.

Although the mortgage payment wasn’t due until the 5th of next month, the money was transferred out of the checking out into their savings account. In this case, treat it like a bill as the concept is to get that money out of sight, removing the temptation of spending it. The two credit cards and the student loan were also paid on the ninth. This leaves the couple plenty of spending money to use on food, gas, entertainment, and other expenses for the next two weeks.

When creating your bi-weekly spending plan, the correct way to convert your monthly amount on expenses without due dates, such as food and entertainment, is to take the monthly amount and divide it by 2.167. Most people will simply divide it by two, but that’s incorrect. If you need to convert the monthly amount to a weekly amount, be sure to divide it by 4.33.

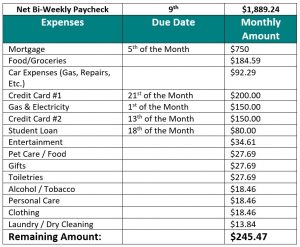

Let’s take a look at the couple’s spending plan for the next paycheck:

5. Sweep Excess Funds Into Savings Account

This is a great opportunity to start saving money that you didn’t think you could. You can save it in a regular savings account or an individual retirement account (IRA) of your choice. If there is credit card debt, take half of the savings and put the other half toward your lowest balance credit card (credit card two in this case).

Biweekly Budgeting Takeaway

The best way to take control of your immediate and future financial situation is to create a plan. Whether you get paid monthly, on the first and the 15th, or bi-weekly, like in this example, it’s important that you make a plan that works for you and your family.

Thank you for your time and effort to write this article. Very reasonable and reassuring.

“Don’t be afraid to pay your bills early. If you got paid on the 9th and the bill isn’t due until the 20th, go ahead and pay it on the 9th. There’s no need to wait until the 20th to make a payment. If you wait until the 19th or 20th to pay it, you are giving yourself 10 days to possibly spend that money on something else. Paying your bills as soon as the money comes into your account will prevent you from wasting money on other non-necessities. This is especially true when they are payments, such as credit cards or car payments, that accrue interest. If balances are being carried, then interest compounds every day. Paying earlier allows you to pay less interest and pay off your cards faster.”

I take issue with this as my credit card through my bank doesn’t count it as a payment and they send me a late notice and charge me a fee. So, you may want to word this differently as it doesn’t apply to every bill.

[…] How to Juggle Monthly Bills With Biweekly Paychecks – DebtWave […]

[…] How to Juggle Monthly Bills With Biweekly Paychecks – DebtWave […]

[…] How to Juggle Monthly Bills With Biweekly Paychecks – DebtWave […]

[…] How to Juggle Monthly Bills With Biweekly Paychecks […]

[…] How to Juggle Monthly Bills With Biweekly Paychecks […]

Bi Weekly pay is just another thing that benefits the employers and screws over the employees. I used to get paid at the beginning of every month. It was great. I paid all my bills and then knew exactly how much money I have for the month to spend/save. When they changed I now did not have enough money to pay all my bills that were due. It started a chain reaction that I’ve never been able to recover from where I’m always paying my bills late.